Our Customers

Taking on the Most

Complex Calculations

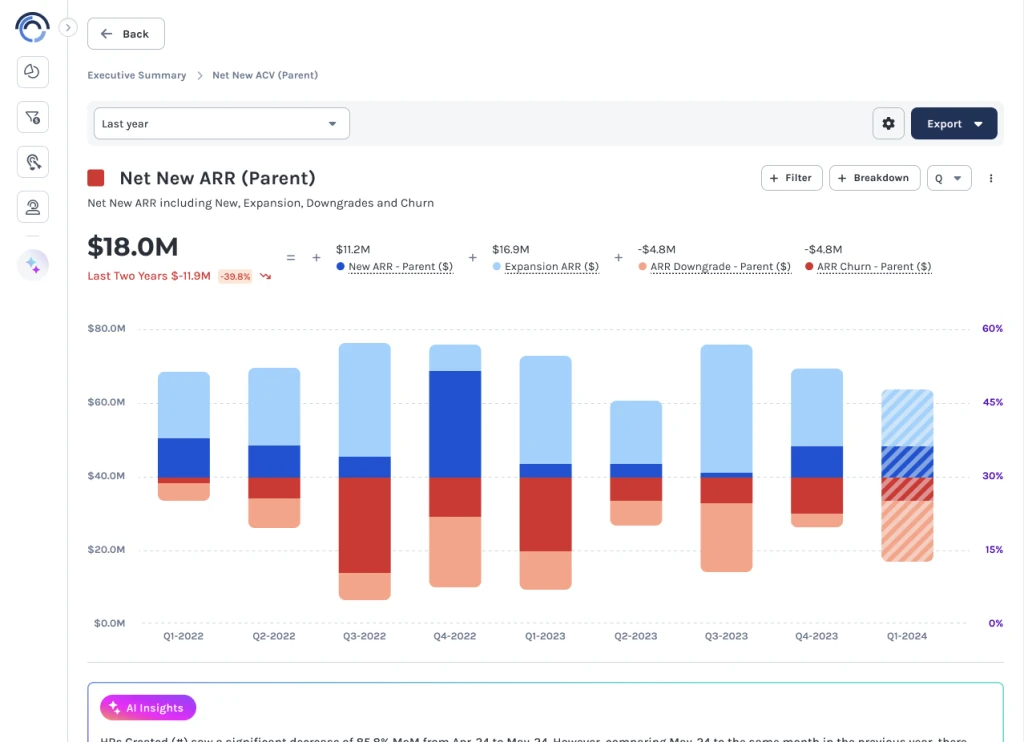

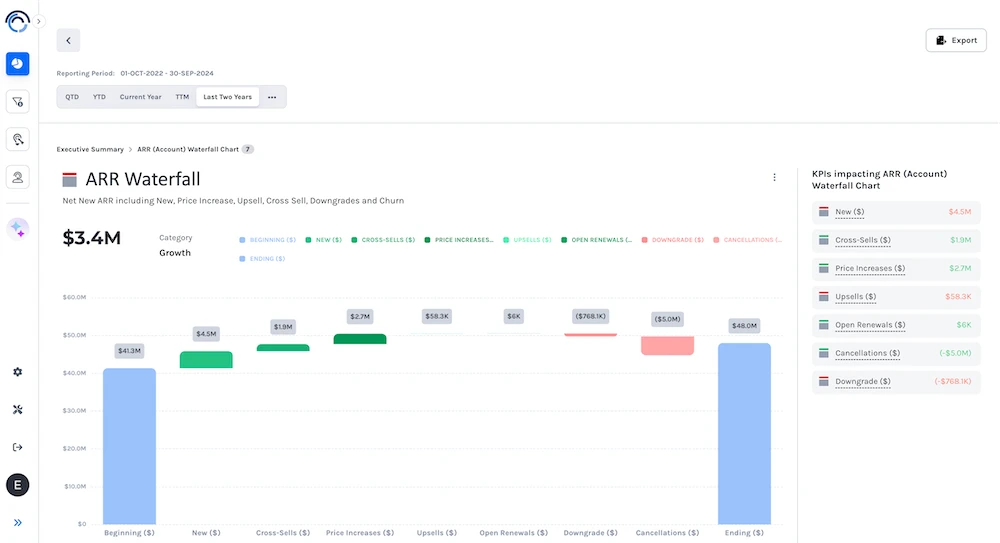

ARR is the key metric for investors and executives alike to evaluate company health and valuation. But, with a complex web of subscription models, add-ons, renewals, and cancellations, pinning down an accurate ARR number can be a big undertaking.

Many SaaS companies are spending several days every month closing out the period for ARR reporting; and even then, many are not 100% confident in their calculation.

At Discern, we’ve transformed this challenge into an opportunity to revolutionize subscription management. Through a meticulous process of defining and programming every subscription scenario, Discern provides clients with complete confidence in their ARR reporting.

No more manual calculations or version control nightmares – Discern’s solutions tracks ARR with 100% accuracy, even snapshotting ARR on a daily basis for a clear audit trail

SaaS Success with ARR Insights

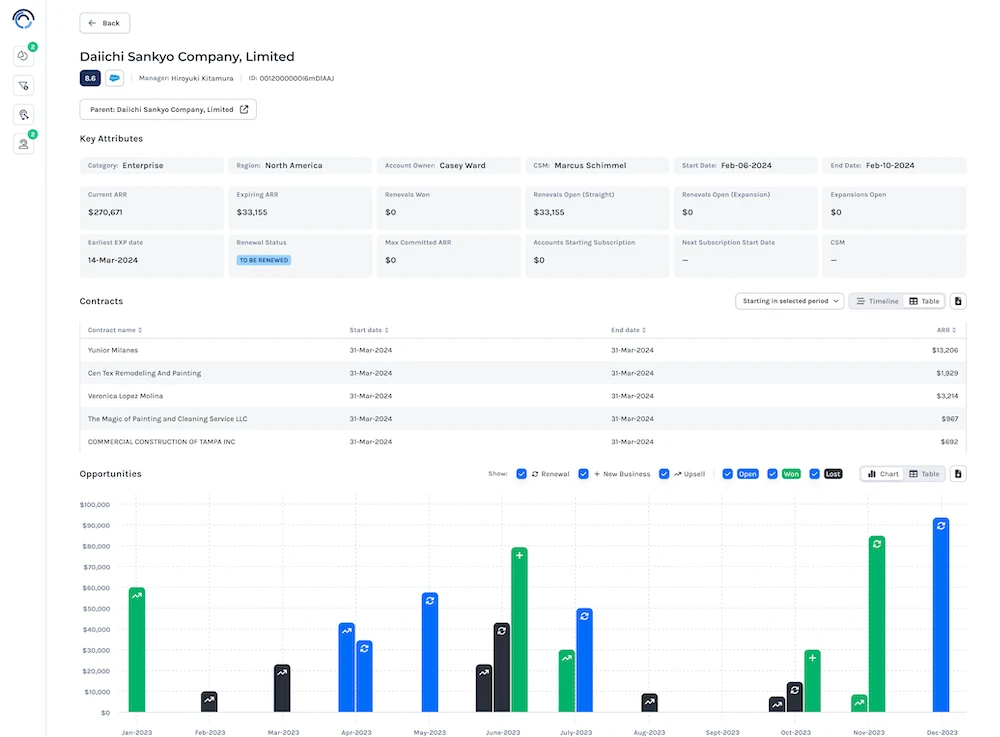

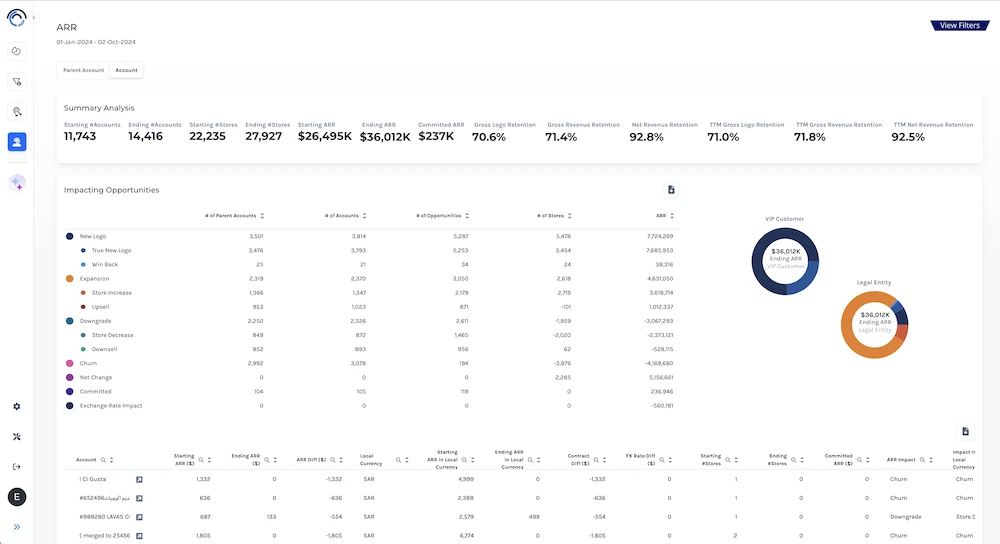

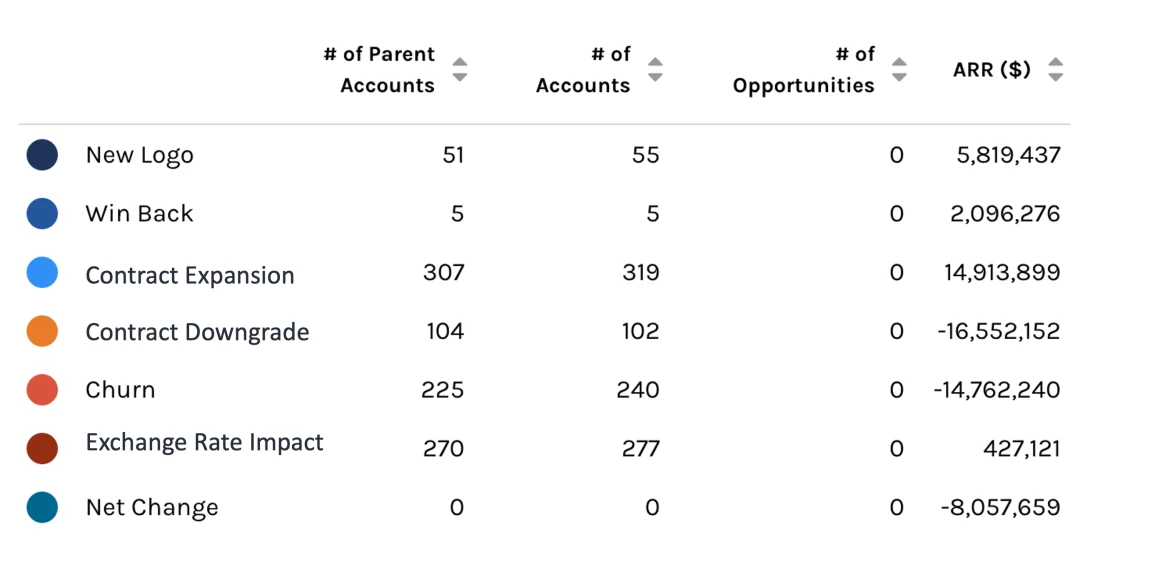

Customer Cube

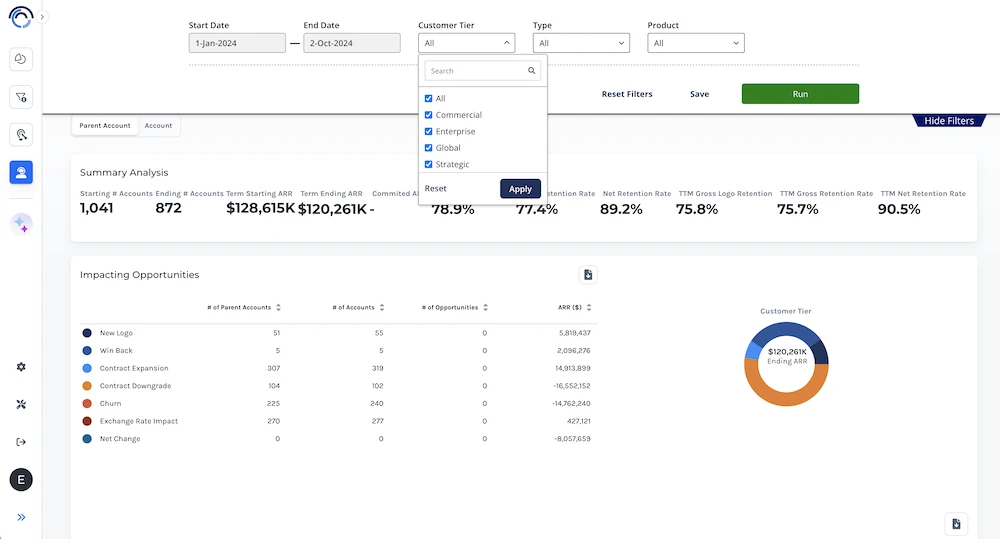

Accurate, consistent ARR calculations help improve investor and stakeholder confidence in a SaaS company’s financial position and growth trajectory. Easily export data in investor favored formats like the Customer Cube.

Pattern Recognition

Discern’s analytics identify the products and customer segments with the best retention rates, informing strategic decisions around product development and customer acquisition.

Operational Efficiency

Discern’s automated calculations eliminate the error-prone spreadsheets that take weeks out of every month to manage, freeing up time for higher-value work.

Alignment

Discern consolidates all financial and customer data into a single source, ensuring the entire team is aligned on the same uniform metrics.

Case Study

The Challenge

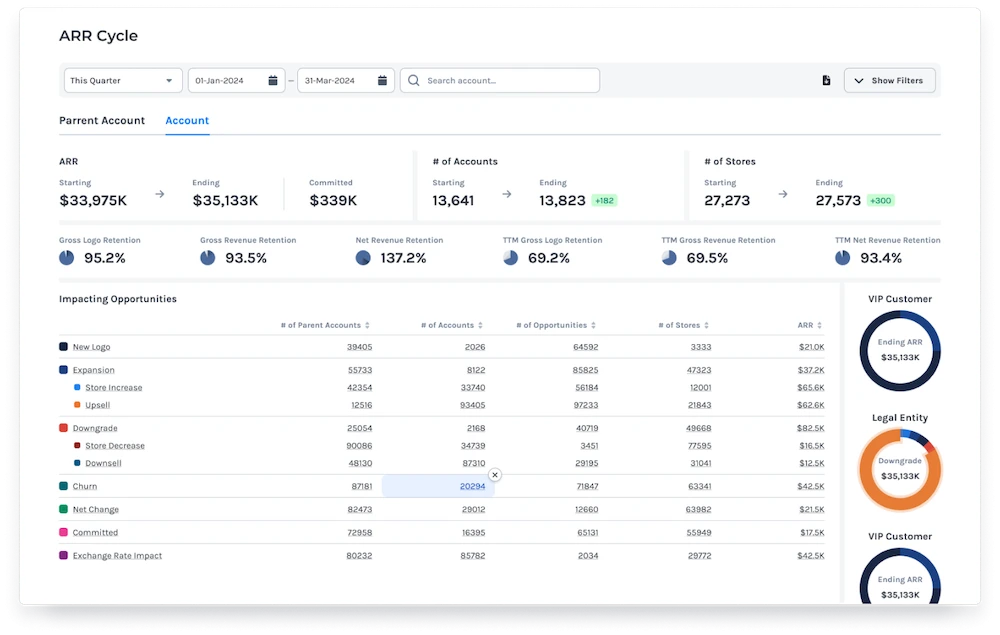

After experiencing five acquisitions within a single year, ScalePad faced mounting complexity in managing customer subscription and transaction data across multiple systems. Without detailed upsell, cross-sell, contraction, and churn data by product or segment, it was difficult to access the information needed to pinpoint trends and make informed decisions.

Discern’s Solution

By unifying data in ScalePad’s multiple billing systems, standardizing data processes, and applying custom logic, Discern successfully automated ScalePad’s MRR/ARR calculation with visibility into underlying details.

Discern FAQs

Calculating ARR is no simple feat, but we have lots of experience handling some of the most complex scenarios.

Discern is able offer MRR and ARR automation by delivering a blended approach of ARR expertise and flexible technology.

During implementation, we work with you to define all subscription scenarios and ARR accounting rules.

Then, we set up integration to your revenue system of record, whether that’s your ERP, Billing System or CRM and code rules to support each scenario. We can incorporate multiple data sources to tie subscriptions to opportunities to invoices.

After the data starts flowing, we work with you to reconcile the data and set up additional rules and logic as needed.

Yes, in addition to your ARR / MRR calculations and retention or revenue growth rate metrics, Discern can also calculate key metrics like CARR. We do this by including revenue for an annual contract that have been signed but the subscription start date has not yet begun. This way, you can get an even more holistic view into your existing customers.

Yes. Discern automatically builds your customer cube by pulling clean, time-based ARR data from your CRM, ERP, and billing systems. You’ll get a ready-to-use view of revenue by customer, product, and time period—ideal for customer journey analytics and investor reporting.

We sure do. Firstly, Discern captures ARR / MRR on a daily basis so you can see metrics for any point in time. We can also snapshot your ARR so as changes to accounting logic or restatements occur, you can see what was previously reporting.

Discern works with many global companies and know the impact conversion rates can have on revenue numbers. Because the platform is so flexible, we can handle conversion rates any way you want, but here are a few common options for a subscription business:

- Constant Currency Method: Use the exchange rate from the contract’s start. This provides stability in ARR reporting by isolating business performance from currency fluctuations.

- Regular Update Method: Apply current exchange rates to all contracts periodically. This reflects the most current valuation of ARR but can introduce volatility in reporting.

- Hybrid Approach: Use constant currency for ongoing contracts and current rates for new or renewed contracts. This balances stability for existing contracts with accurate valuation for new business.

- Separate Reporting: Report ARR in both local currency and converted currency, offering transparency and allowing stakeholders to see both native performance and global valuation.

- Exchange Rate Impact Isolation: Create a separate line item in ARR waterfall charts for FX impact, clearly distinguishing between business-driven changes and currency-driven changes in ARR.

Pricing varies based on customer size (annual revenue and number of customer accounts) but starts at an annual subscription of $10,000 per year. We also have a one time implementation fee that includes our consulting, integration, mapping and reconciliation work.

Book a meeting so we can learn more about your SaaS company and provide an accurate quote.

Want to save time calculating ARR during your monthly close?

Book a meeting with our team to discuss your unique subscription scenarios and explore how Discern can help.

Industry FAQs

Calculating the ARR metric is much more complex than simply multiplying the Monthly Recurring Revenue (MRR) by 12 (as chatGPT will tell you). We recommend taking a look all all of your customers’ billing cycles, the recurring contract value there-within and adding up each subscription, including cross sells and upsells, and subtracting downgrades or churns. Most companies are doing this in spreadsheets, or with a tool like Discern.

It is important to also establish business rules and logic for the edge cases. If you need help defining these edge cases and defining treatment for ARR accounting, you can check out our comprehensive Edge Case article here.

By focusing on ARR, companies can better forecast revenue, gauge customer satisfaction, and monitor the effectiveness of their customer acquisition strategies. Additionally, these calculations help in assessing the financial health of a business, providing insights into net dollar retention and the potential for growth.

ARR and general revenue differ primarily in their composition and predictability. Annual recurring revenue refers to recurring revenue generated from existing customer subscriptions and is specifically used in subscription businesses and SaaS. This focus on recurring subscription revenue offers businesses a stable forecast of growth and financial stability.

In contrast, general revenue encompasses all income sources, including one-time purchases, non-recurring services, and other irregular income streams. Unlike the ARR metric, general revenue can fluctuate significantly and does not provide the same level of predictability. Understanding this difference is crucial for companies relying on subscription models, as it impacts everything from revenue recognition practices under Generally Accepted Accounting Principles (GAAP) to long-term customer relationship management and customer longevity.

Technically, one formula for calculating Annual Recurring Revenue (ARR) is:

ARR = Monthly Recurring Revenue (MRR) × 12

This formula helps many SaaS businesses operating on a subscription model to convert their monthly revenue from recurring subscriptions into an annual figure, providing a clear view of the annual revenue. But due to edge cases, the calculation usually isn’t quite this simple.

At Discern, the way we calculate ARR is by looking at:

Starting ARR + New Logo ARR + Expansion ARR + Cross-Sell ARR – Downgrade ARR – Churn ARR

Regardless of how you calculate ARR, companies can use this metric to measure their financial stability, forecast revenue, and understand their future growth. The recurring revenue model is pivotal for evaluating the success of customer retention strategies, assessing customer lifetime value, and planning for long-term growth. It also plays a key role in forecasting financially, allowing companies to allocate resources efficiently and attract investors by demonstrating the stability and predictability of their revenue streams.

ARR is an important metric specific to businesses operating on a subscription model, focusing exclusively on recurring revenue generated from annual subscriptions. ARR emphasizes lasting customer relationships and stable cash flow, which are key for financial stability and forecasting future business health. Recurring Revenue, by comparison, encompasses all predictable income that a company expects to receive regularly, not necessarily limited to subscriptions.

Revenue per Opportunity (RPO) differs from both as it quantifies the average revenue that can be expected from each business opportunity, making it broader and less predictable than ARR. ARR provides a clear measure of sustained growth and customer retention, which is crucial for businesses seeking to understand their growth path and the efficiency of their operations.

ARR is reported in financial statements, adhering to Generally Accepted Accounting Principles (GAAP). This key metric reflects predictable revenue from recurring customer contracts, vital for stakeholders assessing the company’s financial stability and growth prospects.

In financial statements, ARR is often highlighted to showcase a company’s ability to generate consistent revenue, supporting decisions related to investor relations and strategic planning. Reporting ARR also helps in evaluating the effectiveness of customer acquisition and retention strategies, providing a solid foundation for financial forecasting and demonstrating the company’s commitment to maintaining a profitable SaaS business model.

Monthly Recurring Revenue (MRR) is a vital metric for businesses using subscriptions, reflecting the total recurring revenue generated from monthly subscriptions. To calculate MRR, businesses sum up all recurring charges for the month across all customers.

This includes monthly fees from annual contracts prorated over the year. MRR provides insight into the short-term financial health of a company and aids in making operational decisions related to allocating resources and gaining new customers. It is crucial for tracking revenue changes month-over-month and understanding the impacts of new customers and existing retention of customers on the overall revenue.

The main difference between Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR) lies in the period they cover and their usage in business forecasting. ARR aggregates the recurring revenue expected annually, providing a long-term perspective of financial stability, essential for annual planning and investor reporting.

MRR, on the other hand, measures the same thing on a monthly basis, offering a more granular view that is useful for short-term decisions and monthly performance evaluations. Both metrics are pivotal in assessing the financial trajectory of subscription-based and SaaS companies, with ARR used for more strategic planning and MRR for operational management.

ARR stands for Annual Recurring Revenue, and MRR stands for Monthly Recurring Revenue. These metrics are critical for businesses with subscription models, such as SaaS companies, where they measure the predictable and recurring revenue generated from subscriptions over annual and monthly periods, respectively.

ARR and MRR provide insights into the company’s revenue stability and growth, critical for forecasting, strategic planning, and evaluating the company’s success in maintaining lasting customer relationships and maximizing each customer.

An ARR report is a financial document that outlines a company’s Annual Recurring Revenue. It is extensively used in financial analysis to provide investors and stakeholders with insights into the company’s predictable revenue from recurring subscription models.

The ARR report helps in assessing the sustainability and growth potential. It is pivotal for strategic planning, as it allows companies to forecast future revenue, gauge customer retention rates, and understand the overall financial health. This report is instrumental in making informed decisions regarding resource allocation, customer acquisition strategies, and long-term business sustainability, particularly for SaaS and other subscription-based businesses.

Choosing the right sales forecasting software for your business depends on your organization’s unique needs. If you have a large sales team, it is best practice to run sales forecasts out of forecasting software like Discern. However, if you have a small sales team, you can probably get away with running your forecast in your CRM or in Excel.

However, regardless of the size of your sales team, the benefits of running your sales forecasts in a forecasting tool like Discern includes:

- Sales forecast snapshot and trend analysis

- Sales forecasting accuracy scores by AE and team

- Bi-directional CRM sync for easy CRM field cleanup

- Automated sales reports for forecasting

The best forecasting tools should should tighten your sales process, provide real time insights and deliver forecasts that can be trusted by your CEO, finance team and investors.