What is Cash Runway?

Cash Runway is a financial metric that measures the number of months a company can continue operating without running out of cash. It represents the duration during which a business can cover its operating expenses and financial obligations based on its current cash balance and expected cash inflows.

Why is it Important to Measure Cash Runway?

Measuring Cash Runway is critical for assessing a company’s financial sustainability and its ability to weather challenges or disruptions. It provides insights into the company’s liquidity and the time available to implement strategies for securing additional funding, achieving profitability, or making necessary operational adjustments. Cash Runway is a key indicator for investors, creditors, and company management to gauge the financial health and viability of a business.

How Do you Calculate Cash Runway?

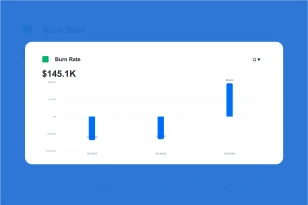

Cash Runway is calculated by dividing the current cash balance by the average monthly cash burn rate. The formula is as follows:

Current Cash Balance / Burn Rate

For example, if a company has $500,000 in cash and its average monthly cash burn rate is $100,000, the Cash Runway would be 5 months.

How To Improve Cash Runway

Improving Cash Runway involves managing cash flow effectively and implementing strategies to extend the time a company can operate without additional funding.

- One key approach is to optimize operating expenses by identifying cost-saving opportunities without compromising essential functions. This may involve renegotiating contracts, reducing discretionary spending, and streamlining operations.

- Increasing cash inflows through revenue generation is another critical aspect of improving Cash Runway. This can be achieved through initiatives such as expanding customer acquisition efforts, launching new products or services, and exploring additional revenue streams.

- Negotiating favorable payment terms with suppliers and customers can also impact Cash Runway positively. Extending payment terms with suppliers provides the company with more time to use cash on hand before settling obligations, while ensuring timely collections from customers enhances cash inflows.

- Lastly, seeking external funding through various sources, such as equity financing or debt financing, can inject additional capital into the business and extend the Cash Runway. This requires careful consideration of the company’s financial structure, risk tolerance, and growth strategy.

Regularly monitoring Cash Runway and adjusting strategies in response to changes in the business environment allows companies to navigate financial challenges proactively and ensure long-term sustainability.