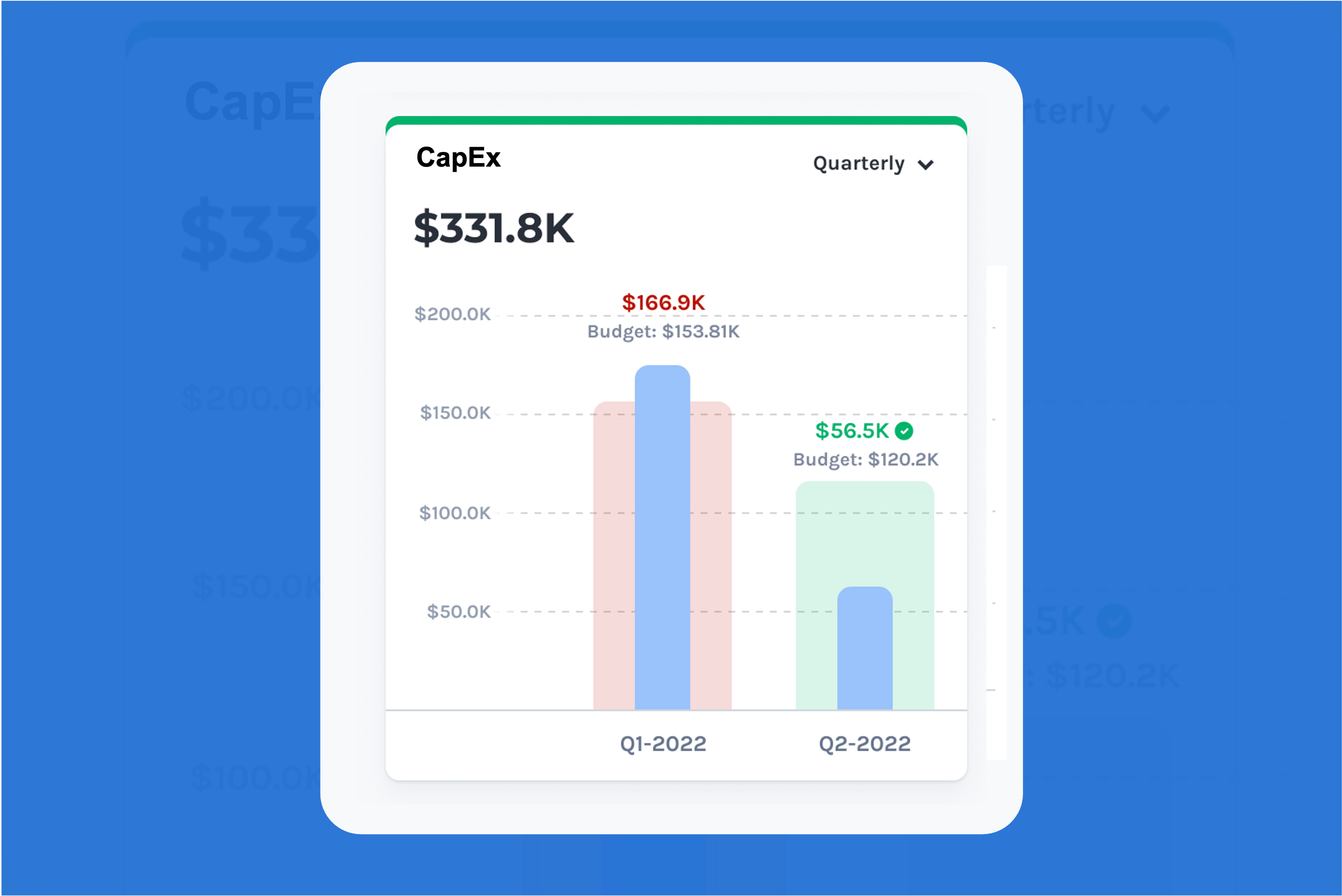

What is CapEx?

Capital expenditures (CapEx) are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment. CapEx is often used to undertake new projects or investments by a company.

Why is CapEx an Important Metric to Monitor?

CapEx reflects strategic investments in long-term assets, guiding a company’s growth, competitiveness, and operational efficiency. It ensures that assets are well-maintained and utilized optimally, contributing to a company’s long-term viability.

By tracking CapEx, companies can strategically plan for growth and expansion, allocate funds effectively, and assess return on investment. It helps manage cash flow, navigate regulatory compliance, and align investments with sustainability goals, addressing environmental concerns.

Effective CapEx management not only mitigates asset-related risks but also instills investor and stakeholder confidence.

How to Calculate CapEx?

Calculating CapEx involves determining the total amount of money a company invests in acquiring, upgrading, or maintaining long-term assets during a specific period. To calculate CapEx:

- Identify Eligible Expenditures: Determine which expenditures qualify as capital expenditures. These are typically costs associated with long-term assets that will provide future benefits.

- Gather Expenditure Data: Collect data on the actual expenditures made during the specified period for each eligible item. This information can come from invoices, receipts, or financial records.

- Determine the Total CapEx: Sum up all the eligible capital expenditures made during the chosen period. This will give you the total CapEx for that period.

It’s important to understand that the timing of the expenditure is what matters. Even if you pay for an asset over several months or years, the entire amount spent on that asset during the accounting period should be included in CapEx for that period.

Be sure to distinguish between expenses that are classified as operating costs, such as regular repairs and maintenance, and those that qualify as CapEx. Operating costs are typically accounted for separately on the income statement.

How to Improve CapEx

To improve Capital Expenditure (CapEx) management, begin with strategic planning and align investments with your business goals. Conduct thorough ROI analyses for potential projects and prioritize those with higher returns. Optimize asset utilization, invest in efficiency improvements, and consider leasing or renting equipment to reduce upfront costs. Negotiate favorable terms with suppliers and maintain assets to extend their lifespan. Embrace sustainability and technology while closely monitoring project budgets, implementing cost controls, and assessing risks. Regularly review your CapEx strategy and benchmark against industry standards for more effective capital investment.