Introduction: Why SaaS Businesses Need a Complete Revenue Bridge

In subscription-based models, growth and valuation depend on recurring revenue visibility — not just on what you’ve earned but also on what’s contracted, billed, collected, and recognized.

However, SaaS leaders often struggle to reconcile five critical financial components:

- ARR (Annual Recurring Revenue) – Contracted, recurring commitments.

- Invoices – Billed amounts for contracted services.

- Accounts Receivable (A/R) – Invoices issued but not yet paid.

- Deferred Revenue – Cash received for future service obligations.

- Cash – Actual funds collected.

Each plays a unique role in bridging bookings to billings, billings to revenue, and revenue to cash flow. Understanding their connection ensures your balance sheet, income statement, and cash flow statement align perfectly.

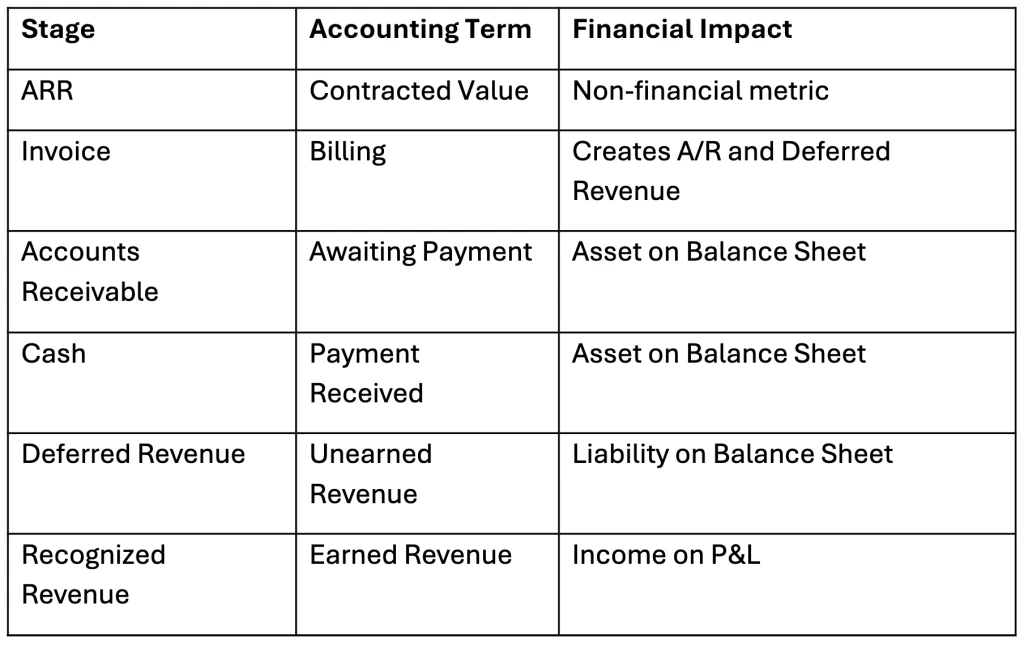

The SaaS Revenue Flow: ARR to Cash Lifecycle

Here’s how the complete flow works:

- ARR (Annual Recurring Revenue) – Represents total contracted recurring value (e.g., $120,000 for a 12-month SaaS deal).

- Invoice Issuance – The contract is billed (annually, quarterly, or monthly).

- Accounts Receivable (A/R) – The billed amount is due but not yet collected.

- Cash Collection – Customer pays, converting A/R to Cash.

- Deferred Revenue Creation – The collected cash is recorded as a liability until the service is provided.

- Revenue Recognition – Deferred revenue is released into recognized revenue monthly as services are delivered.

This process shows how SaaS revenue evolves from contracted value (ARR) to earned income (recognized revenue) to liquid assets (cash).

1️⃣ ARR: The Contract Foundation

ARR represents the annualized value of active recurring contracts. It measures growth momentum and predictability.

However, ARR is non-financial — it’s not reflected on your financial statements. Instead, it informs billings, which lead to invoices.

Example:

A 12-month, $12,000 subscription = ARR of $12,000.

Billing frequency (monthly or annually) determines when it becomes invoice and revenue.

2️⃣ Invoices: From Contracts to Billings

Invoices formalize the right to collect money from customers.

They can be issued before or after service delivery depending on billing policy.

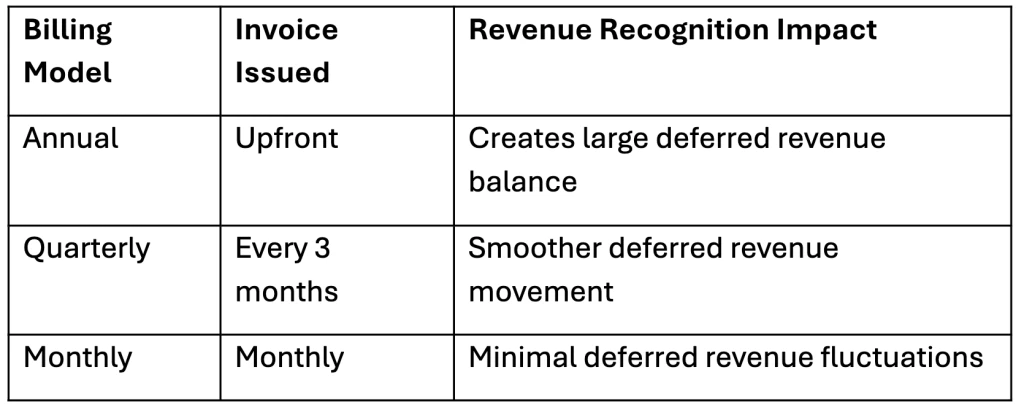

Invoice Timing Matters:

Invoices are the trigger point for both Accounts Receivable and Deferred Revenue.

3️⃣ Accounts Receivable (A/R): The Bridge Between Invoice and Cash

Once an invoice is sent, it creates Accounts Receivable (A/R) — the amount owed by a customer.

A/R sits on the balance sheet as an asset, representing revenue that’s been billed but not yet paid.

Example:

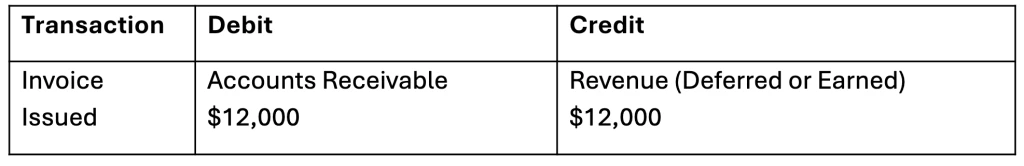

You issue a $12,000 annual invoice on Jan 1.

- If the customer hasn’t paid yet, it remains A/R.

- Once payment arrives, A/R decreases and Cash increases.

A/R Journal Entry Example:

If you recognize the revenue over time, that $12,000 will move from Deferred Revenue to Recognized Revenue as months pass.

4️⃣ Cash: When A/R Converts into Liquidity

Cash is recorded once payment for an invoice is received.

In SaaS, payments often occur upfront, meaning cash inflows precede revenue recognition.

This timing difference explains why cash flow and profitability can look very different in subscription businesses.

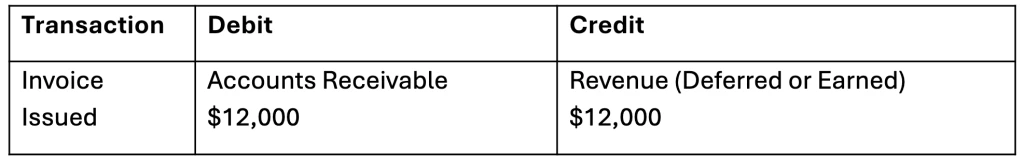

Example Flow:

- Invoice issued → A/R created

- Payment received → A/R cleared, Cash increased

- Revenue earned → Deferred revenue reduced, Recognized revenue increased

Accounting Entry:

5️⃣ Deferred Revenue: Cash Collected for Future Services

Deferred revenue represents unearned income — cash received in advance of fulfilling obligations.

It sits as a liability on the balance sheet because the company still owes service time.

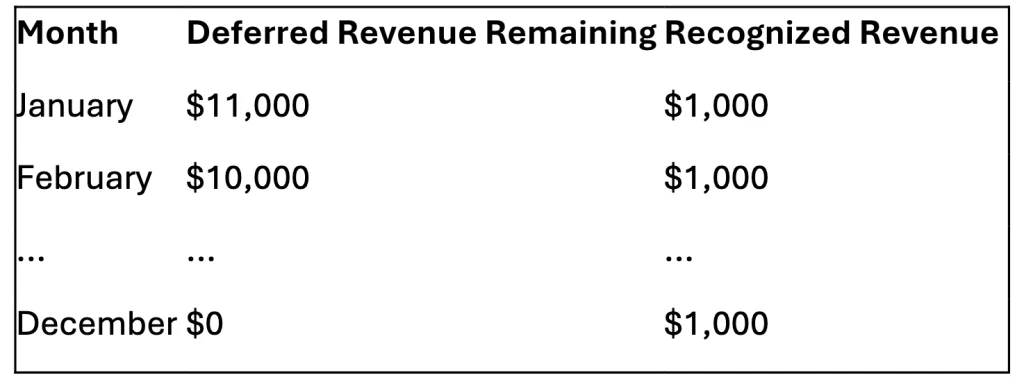

Example:

A customer prepays $12,000 for a 12-month subscription in January.

→ The company recognizes $1,000 each month while $11,000 remains deferred.

This ensures compliance with ASC 606 and IFRS 15, both of which mandate recognizing revenue only when earned.

6️⃣ Recognized Revenue: When Performance Obligation is Met

Recognized revenue reflects income from services delivered within the period.

Each month, a portion of Deferred Revenue becomes Recognized Revenue.

This structured recognition ensures accurate income reporting and aligns the income statement with the balance sheet.

Putting It All Together

ARR → Invoice → A/R → Deferred Revenue → Revenue → Cash

Below is a simplified visualization of the SaaS revenue lifecycle:

This full-cycle understanding eliminates confusion between what’s booked, billed, earned, and collected — a critical distinction for SaaS CFOs.

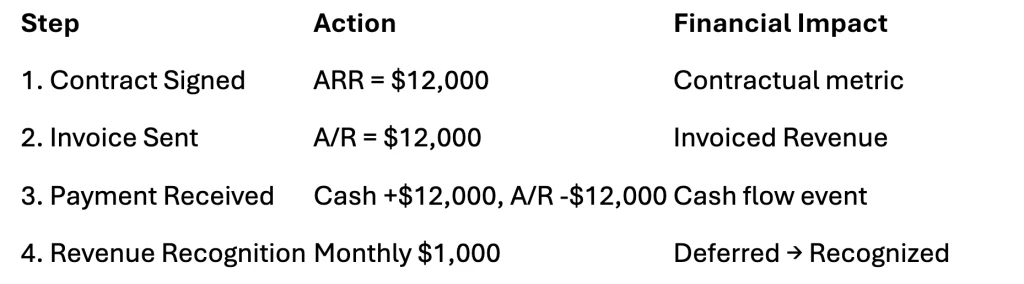

Practical Example: Annual Prepaid SaaS Subscription

This model shows how a single contract affects every financial statement over time.

Best Practices to Manage ARR, Invoices, A/R, and Deferred Revenue

- Automate Your Billing and A/R Tracking: Tools like Discern can sync contracts, invoices, and payments.

- Reconcile ARR with Invoice Data Monthly: Ensure contracted ARR aligns with billed and unbilled revenue schedules.

- Monitor Aging Receivables: Keep DSO (Days Sales Outstanding) low to maintain healthy cash flow.

- Create Revenue Waterfall Reports: Track how deferred revenue converts into recognized revenue over time.

- Align Finance and RevOps Teams: Use shared dashboards for ARR, invoice, A/R, and revenue data.

FAQs on ARR, Invoices, Accounts Receivable, and Deferred Revenue

It remains in Accounts Receivable until payment is collected or written off as bad debt.

Yes, ARR includes all active contracts, even if not invoiced or paid yet.

No. Deferred revenue is a liability (cash received in advance), while A/R is an asset (money owed by customers).

At least monthly — this ensures your revenue waterfall aligns with your general ledger.

Platforms like Discern can bring together and calculate contracts, invoices, A/R, and revenue schedules seamlessly.

Conclusion: The Financial Clarity Framework Every SaaS Business Needs

To truly understand SaaS financials, you must connect the dots between:

ARR → Invoice → Accounts Receivable → Cash → Deferred Revenue → Recognized Revenue

This complete bridge provides accurate forecasting, audit-ready reporting, and trustworthy data for investors.

By mastering these relationships, SaaS CFOs and founders can make smarter growth decisions and maintain financial transparency.