Beyond Surface-Level Diligence

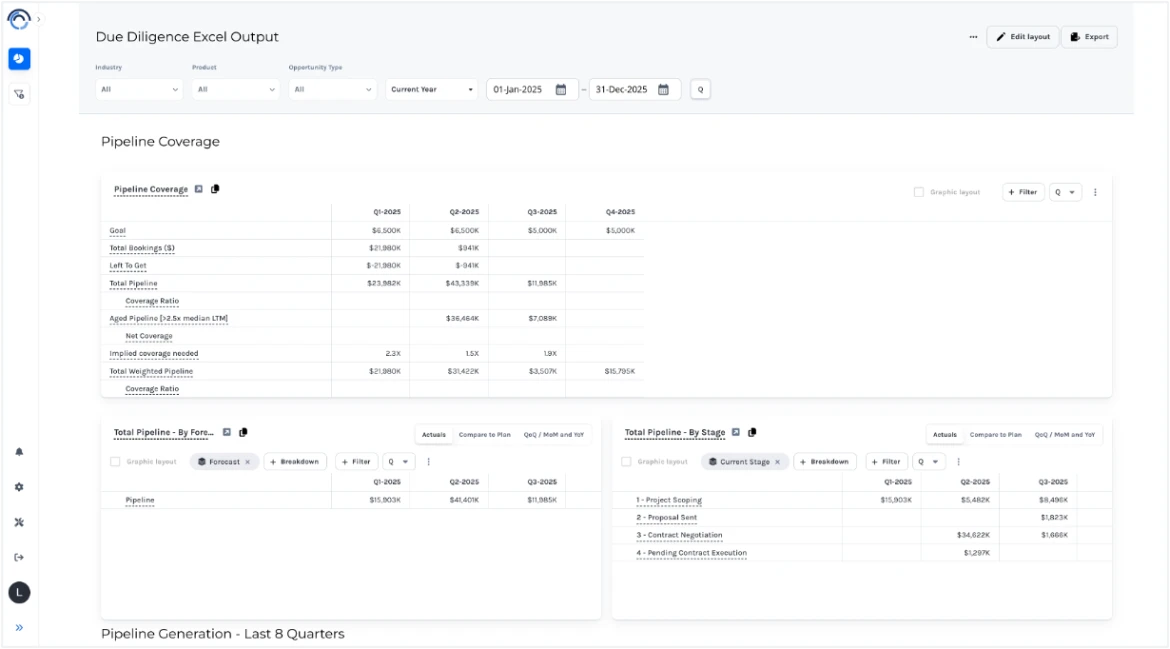

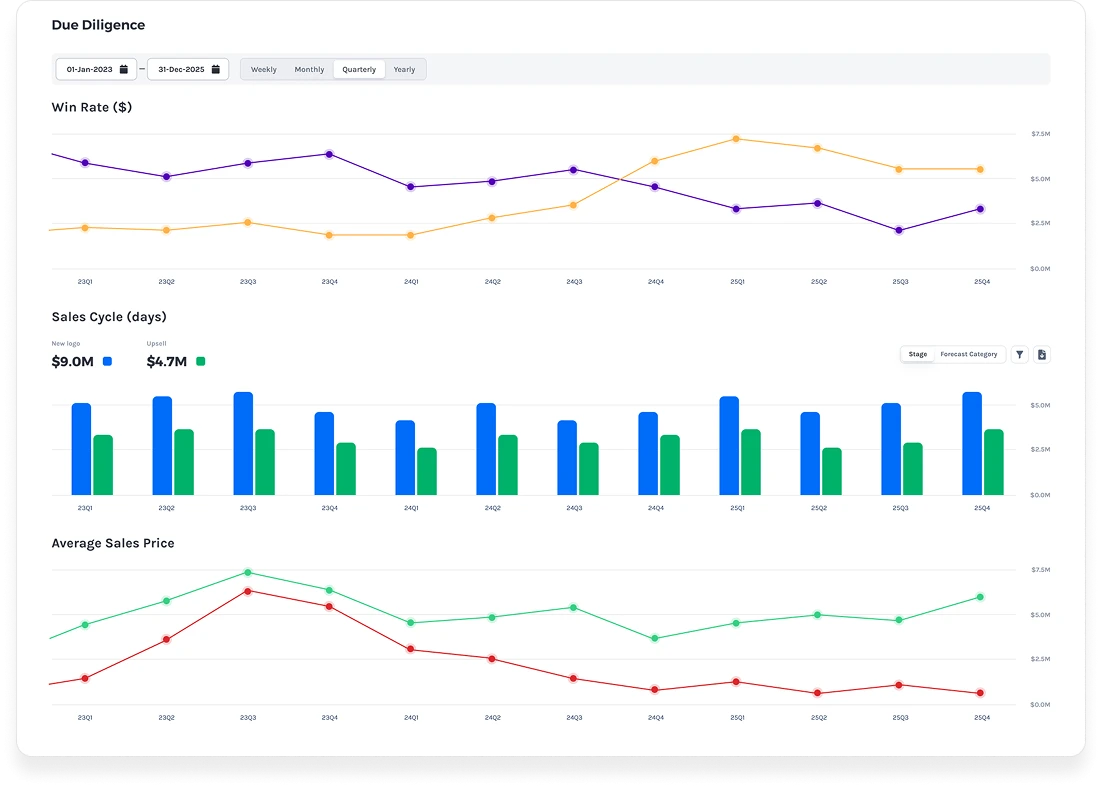

After the investment thesis is set, diligence teams turn to the numbers: pipeline, conversion, forecast reliability, and revenue health. But CRM data is messy, timelines are compressed, and consultants often assign junior analysts with limited GTM experience. The result: expensive and inconsistent diligence that still leaves critical questions unanswered.

Discern changes this.

Our AI-powered solution thoroughly investigates and flags deal data while our GTM specialists – operators who’ve analyzed pipeline data for hundreds of commercial organizations – deliver accuracy, consistency, and insights that traditional firms struggle to match.

The result: expert-grade diligence and revenue forecasts in days, at less than half the cost, with transparency into the data behind every finding. For ICs and deal teams, that means more confidence in valuation decisions: whether to lean in, reprice, or walk away.

Why Leading Firms Choose Discern for GTM Diligence

Half the Cost, Double the Impact

Replace high-fee consulting projects with AI-powered diligence delivered by GTM analytics experts—at half the cost, with more thoroughness and greater depth.

Accuracy and Consistency

Every analysis follows the same structured process, making deal comparisons reliable and repeatable across the portfolio.

GTM Expertise

Where consultants rely on junior analysts, our team has decades of GTM operating experience. We know how to interpret pipeline data because we’ve built and managed it.

Speed Without Sacrificing Rigor

Deliver insights in minutes or days instead of weeks—critical in competitive processes where FOMO drives fast decision-making.

IC-Ready Outputs

Clear, data-backed answers to the questions investment committees care about most: Is growth real? Can this team hit its forecast? Where are the risks?

Optional Portfolio Exit Prep

Apply the same diligence process to portfolio companies preparing for M&A or exit, ensuring cleaner data and stronger valuations.

Choose Your Engagement Model

Best For:

Firms seeking end-to-end diligence services

Includes:

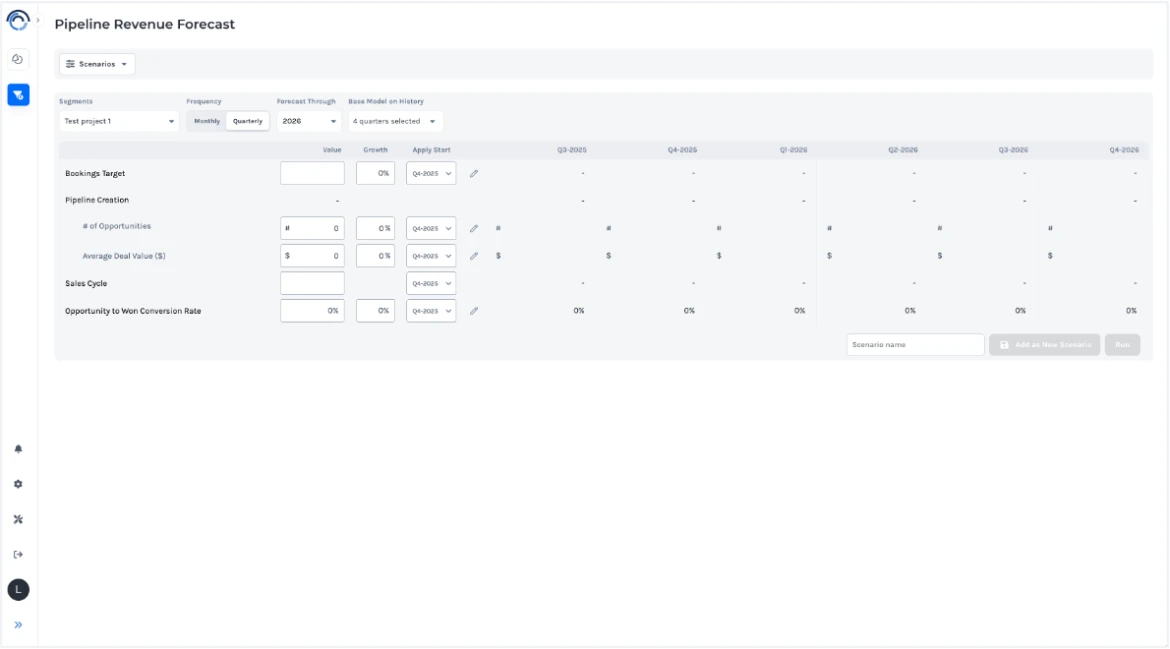

Access to Discern’s SaaS platform. Upload target data, run structured analyses, and standardize outputs across deals.

Best For:

Firms that want repeatable, in-house diligence

Includes:

Our GTM experts deliver IC-ready reports with the same depth you’d expect from big name consultancies—at half the cost, in a fraction of the time, and with specialists who live and breathe GTM analytics.

Discern FAQs

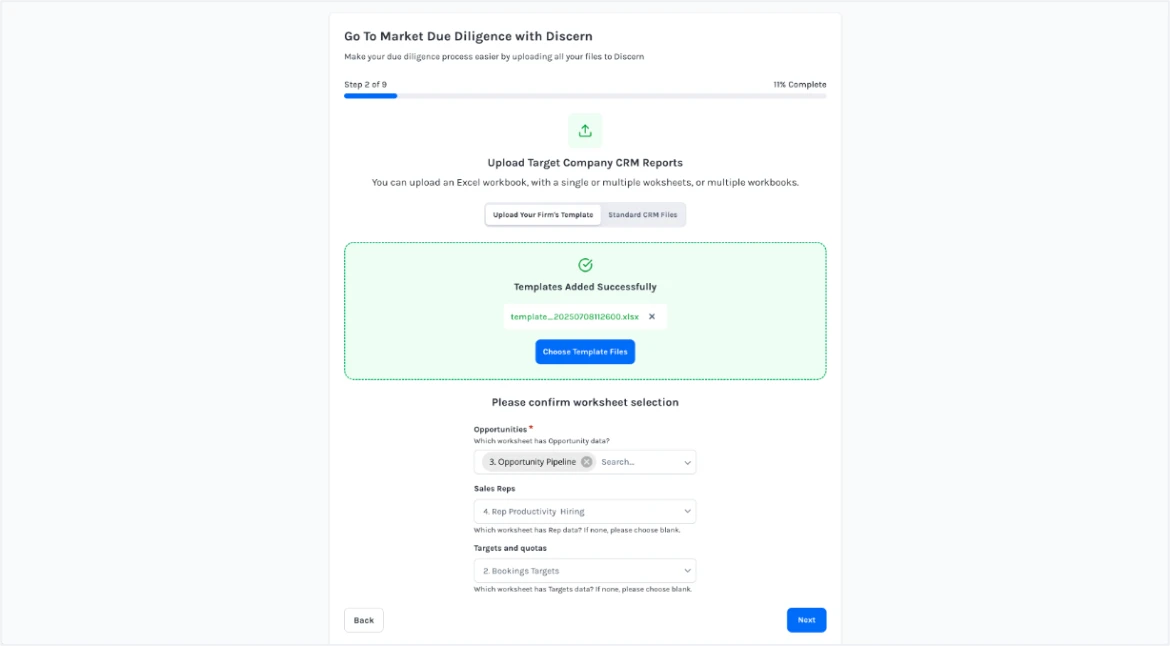

Excel exports, standard CRM reports (e.g., Salesforce, HubSpot), or direct integrations.

Minimal. A single CRM export or data pull is typically enough.

Discern is built for real-world data—our system flags and adjusts for gaps, outliers, and inconsistencies automatically.

Yes. Discern can plug into portfolio company CRMs to support post-close tracking and ongoing commercial analysis.

Our professional service provides the same level of analysis consultants deliver—but faster, with more thorough analysis, at half the cost, and with GTM specialists rather than junior generalists. We focus exclusively on GTM health, which means sharper insights with less noise.

Yes. Many firms use our professional service for initial deals, then adopt the software for repeatable in-house diligence.

Yes. The underlying AI-powered analytics are the similar. The difference is whether your team executes in-platform or our GTM experts connect with your target companies and deliver the outputs.

Confident Decisions Start With Clear GTM Analysis

Discern provides deal teams and ICs with the GTM clarity they need to make confident decisions – whether that means leaning in, repricing, or walking away.

Industry FAQs

PE/VC due diligence refers to the process private equity or venture capital firms use to evaluate a potential investment’s risks, opportunities, and future performance—typically under tight timelines and based on limited data access.

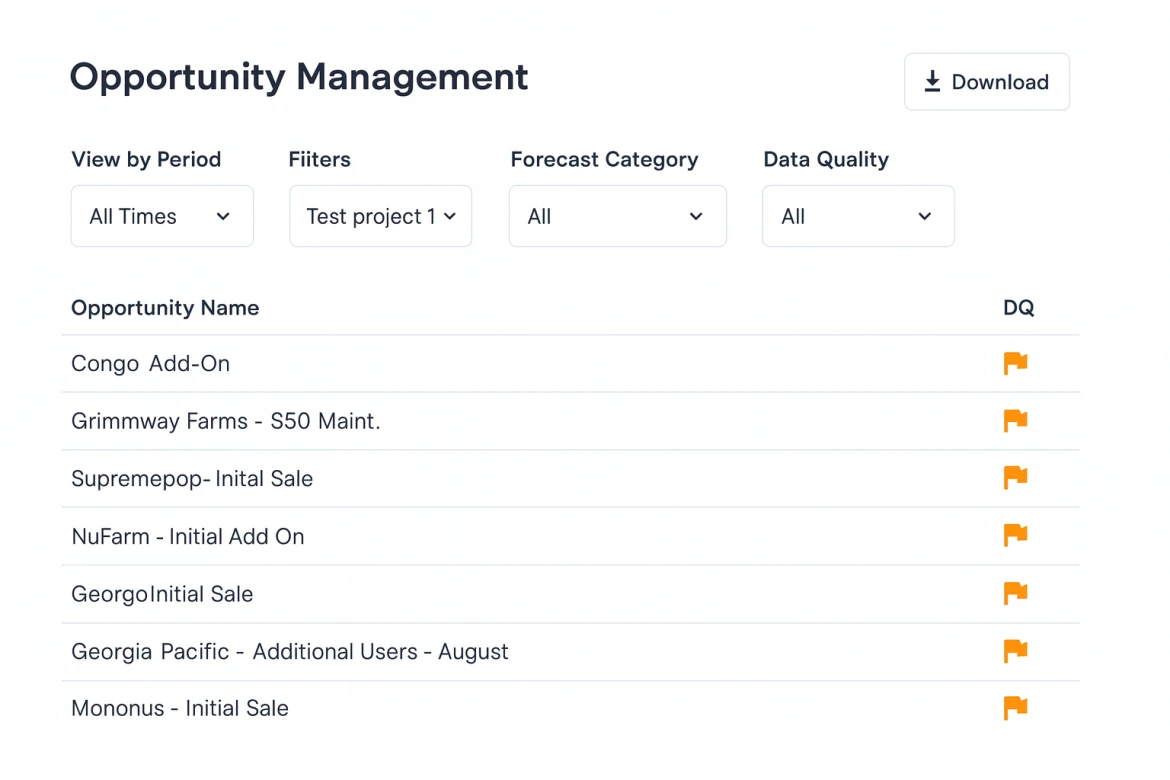

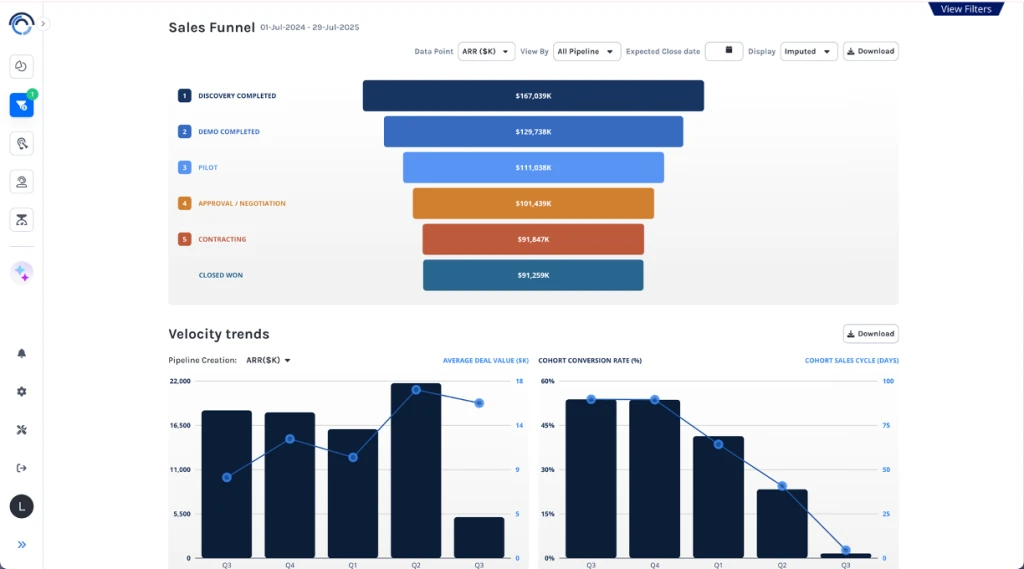

GTM diligence focuses on a target company’s sales pipeline, marketing efficiency, customer segmentation, and forecast accuracy. It requires a different analytical toolkit than financial or legal diligence.

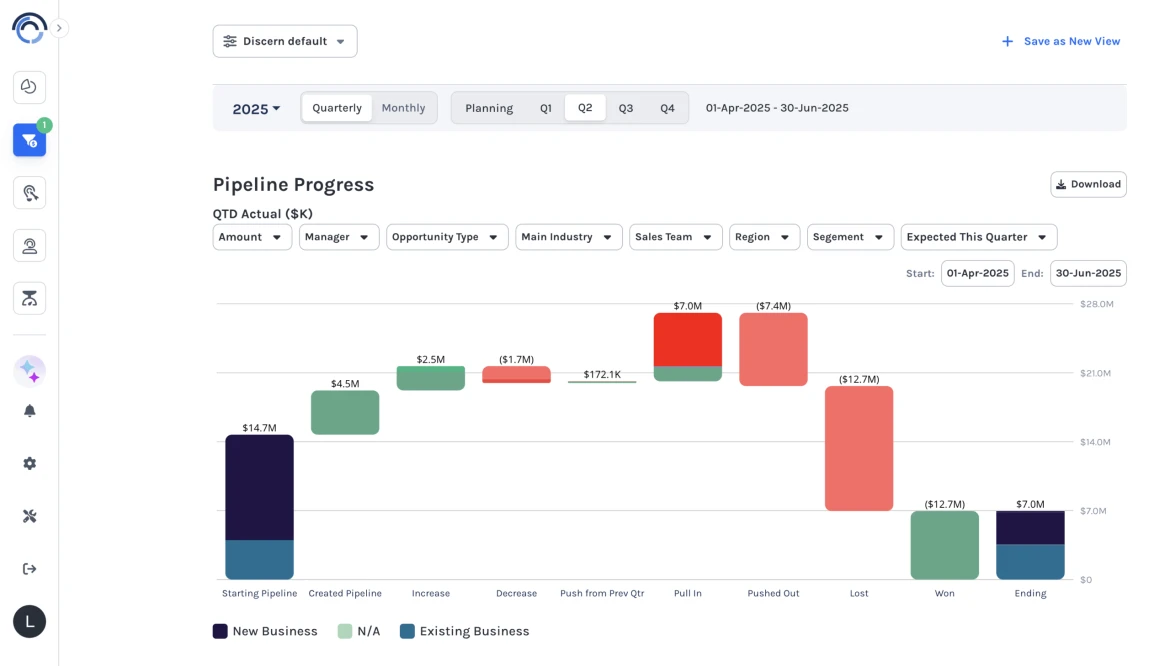

Sales pipeline health often determines future revenue—and directly impacts valuation. Inconsistent pipeline metrics can obscure risks or overstate opportunity, making accurate GTM analysis critical.

Many firms still use Excel and pivot tables, but leading teams are adopting tools like Discern to automate pipeline analytics, forecasting, and presentation creation.

Discern eliminates manual analysis work, ensures consistent methodology across deals, and provides faster, deeper insights into sales performance and revenue forecasting.

On the other hand, Discern’s customizable KPI analytics offer SaaS companies a cost effective solution to automatically calculate, monitor, and report on KPIs.

Yes. Post-close, Discern integrates with portfolio CRMs to support live monitoring, value creation tracking, and performance benchmarking across investments.