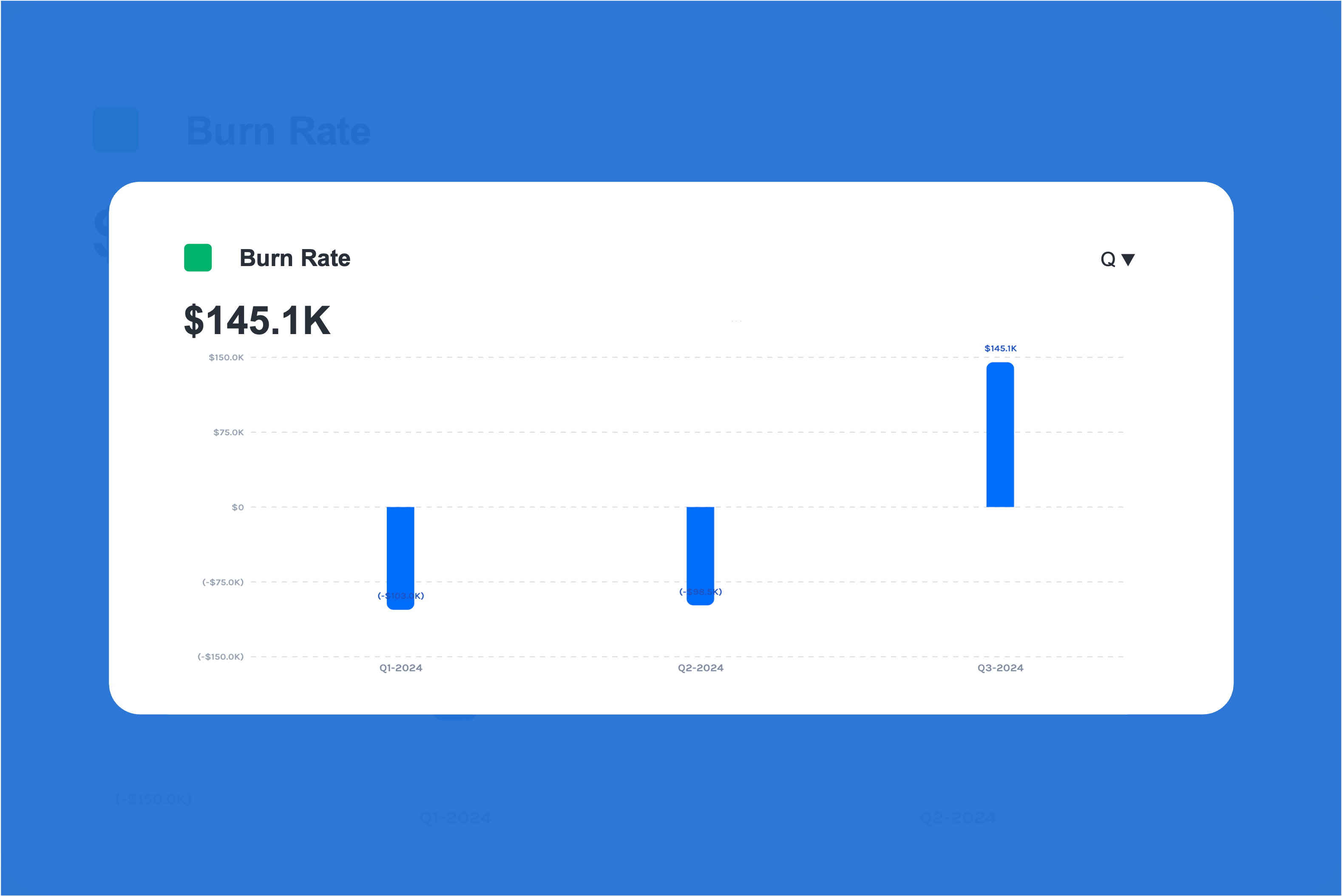

What is Burn Rate?

The burn rate is the pace at which a new company is running through its startup capital ahead of it generating any positive cash flow. The burn rate is typically calculated in terms of the amount of cash the company is spending per month and is computed by averaging the cash from operations over the selected period.

Why is Burn Rate an Important Metric to Monitor?

It’s important for SaaS companies to manage their burn rate carefully to ensure they have sufficient runway to reach profitability or secure additional funding as needed. Maintaining a balance between growth and expenditure is crucial for the long-term success of a SaaS business

Investors closely monitor a company’s burn rate to assess its financial health and sustainability. A high burn rate without corresponding revenue growth can be a red flag, while a well-managed burn rate that aligns with revenue growth is often seen as a positive sign.

Additionally, Burn Rate is important for financial planning. If a company has a high burn rate, the company may want to cut back spend or avoid heavi ly investing in new initiatives.

How Do you Calculate Burn Rate?

Formula

Burn Rate = Operating Expenses – Cash Inflow

The burn rate is calculated by determining the net cash outflow a company experiences over a specified period (usually a month or a year). To calculate the burn rate:

- Identify the Timeframe: Determine the period for which you want to calculate the burn rate. Monthly and yearly burn rates are common. The choice depends on your financial reporting and management needs.

- Gather Financial Data:

- Operating Expenses: Sum up all the company’s operating expenses for the chosen timeframe. This includes expenses like salaries, rent, marketing costs, infrastructure, development, and any other costs directly related to running the business.

- Revenue: If your SaaS company is generating revenue, subtract this revenue from the operating expenses. If your revenue exceeds your expenses, you may have a positive burn rate, which indicates you’re cash flow positive.

- Operating Expenses: Sum up all the company’s operating expenses for the chosen timeframe. This includes expenses like salaries, rent, marketing costs, infrastructure, development, and any other costs directly related to running the business.

- Determine Cash Inflow: If the company received any additional funding or investments during the chosen period, add this amount to the operating expenses. This inflow can come from sources like venture capital, loans, or investment rounds.

- Calculate Burn Rate: Subtract the cash inflow (investment or funding) from the total operating expenses. This will give you the net cash outflow for the specified period, which is the burn rate.

How to Improve Burn Rate

Improving your company’s burn rate, especially in the context of SaaS, typically involves reducing the net cash outflow while maintaining or increasing revenue and growth. For example, a company can consider:

- Increasing Revenue: One of the most effective ways to improve your burn rate is to increase your revenue. You can achieve this through various means, including acquiring more customers, upselling to existing customers, and increasing your pricing. Focus on scaling your sales and marketing efforts to boost revenue.

- Improving Customer Retention: Reducing customer churn (the rate at which customers cancel or don’t renew their subscriptions) can have a significant impact on your burn rate. Happy, satisfied customers are more likely to stay and continue paying for your service.

- Controlling Expenses: Review your operating expenses carefully and identify areas where you can cut costs. This might include renegotiating contracts with vendors, optimizing infrastructure costs, reducing unnecessary overhead, or reevaluating software and tool expenses.

- Flexible Staffing: Consider a flexible workforce, such as freelancers or contractors, to scale up or down as needed. This can be more cost-effective than hiring full-time employees.

- Investments in Upsell Strategies: Focus on upselling additional features or services to existing customers. This can increase the revenue generated from each customer without a corresponding increase in customer acquisition costs.