What is the Rule of 40?

The Rule of 40 is a financial performance metric used in the software as a service (SaaS) and other subscription-based business models. It is designed to provide a balanced view of a company’s growth and profitability by combining the growth rate and profitability margin.

The Rule of 40 posits that a healthy SaaS company should have a combined growth rate and profitability margin that adds up to at least 40%.

Why is it Important to Measure the Rule of 40?

Measuring the Rule of 40 is important for several reasons:

- Balanced Growth: The Rule of 40 encourages a balanced approach to growth, emphasizing that high growth should not come at the expense of profitability. It helps companies avoid unsustainable growth strategies that may lead to financial instability.

- Investor Confidence: Investors often use the Rule of 40 as a quick assessment of a company’s overall financial health. A company that meets or exceeds the 40% threshold is generally considered to be in good financial standing, which can instill confidence among investors.

- Operational Efficiency: The Rule of 40 reflects the company’s ability to balance growth with operational efficiency. It encourages businesses to focus on optimizing operations to achieve a healthy combination of growth and profitability.

- Long-Term Viability: Sustaining a Rule of 40 ratio above 40% suggests that a company is not only growing rapidly but also managing its costs effectively. This bodes well for the long-term viability and sustainability of the business.

How Do you Calculate the Rule of 40?

The Rule of 40 is calculated by adding the company’s revenue growth rate to its profitability margin (as a percentage), and the sum should be equal to or greater than 40%. The formula is as follows:

Rule of 40 Formula

Revenue Growth Rate + Profitability Margin

Here’s a breakdown of the formula:

- Revenue Growth Rate: This is the percentage increase in revenue over a specific period. It is often calculated as the [(Current Revenue – Previous Revenue) / Previous Revenue] * 100.

- Profitability Margin: This is the company’s profitability expressed as a percentage. It is calculated as [(Net Income / Revenue) * 100].

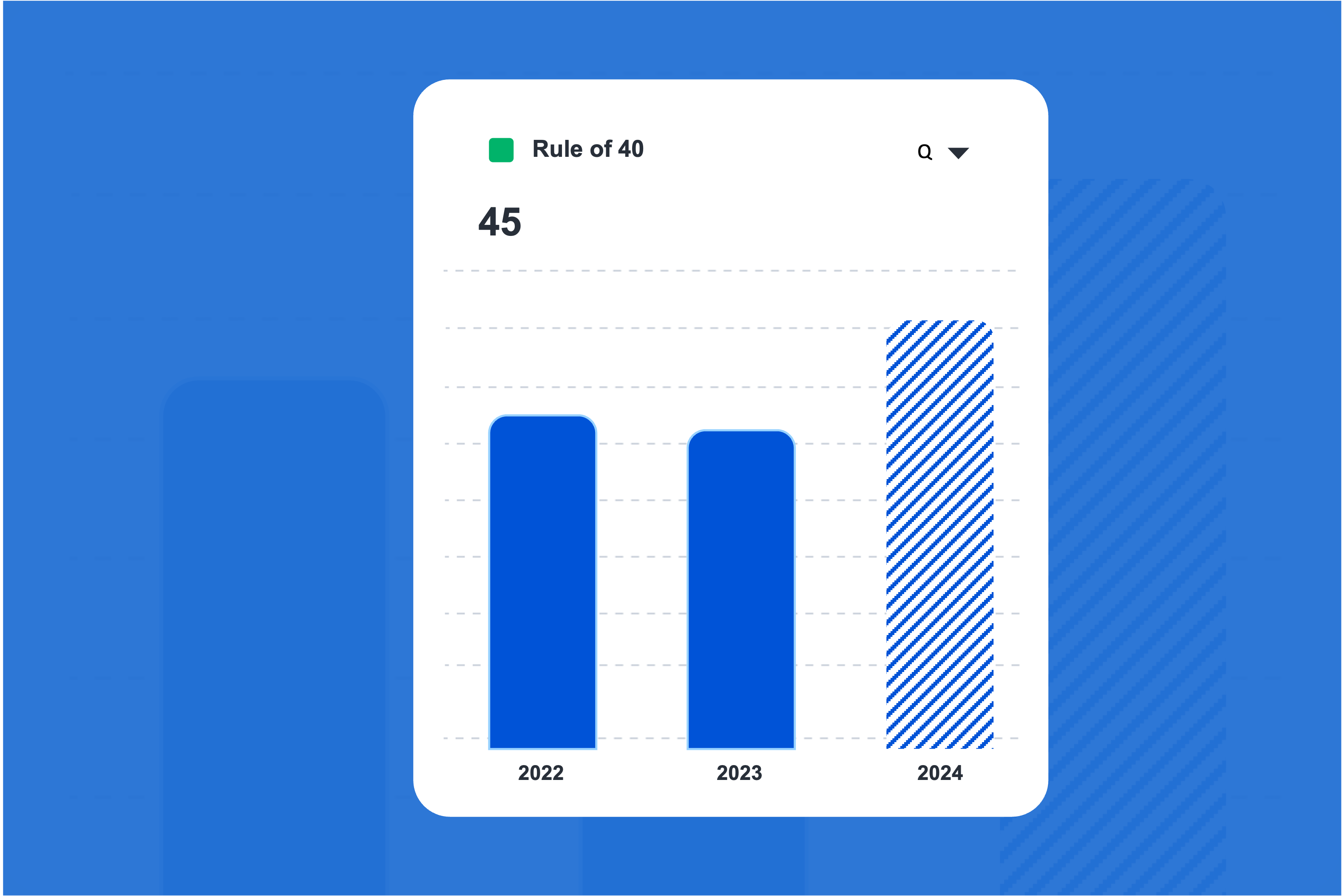

For example, if a company has a revenue growth rate of 30% and a profitability margin of 15%, the Rule of 40 would be 45%. This result exceeds the 40% threshold, indicating a healthy balance of growth and profitability.

How To Improve the Rule of 40?

Improving the Rule of 40 involves strategies to enhance both revenue growth and profitability. Here are key approaches:

- Optimized Pricing: Evaluate and adjust pricing strategies to maximize revenue without compromising customer satisfaction. Introduce tiered pricing or value-based pricing to capture additional revenue.

- Customer Retention: Focus on customer retention to minimize churn. Retained customers contribute to stable revenue and are often more cost-effective than acquiring new customers.

- Operational Efficiency: Continuously optimize operations to reduce costs and improve efficiency. Streamline processes, automate repetitive tasks, and negotiate favorable terms with suppliers to enhance profitability.

- Cross-Selling and Upselling: Implement strategies to encourage existing customers to upgrade their plans or purchase additional services. This contributes to increased revenue without significantly increasing customer acquisition costs.

- Market Expansion: Explore opportunities to expand into new markets or introduce new products and services. Diversifying the customer base and offerings can drive additional revenue growth.

- Cost Controls: Implement rigorous cost controls to manage operating expenses. Regularly review and optimize spending across various departments to ensure efficient resource allocation.

- Marketing Effectiveness: Evaluate the effectiveness of marketing campaigns and channels. Focus on channels that provide a higher return on investment and contribute to sustainable revenue growth.

- Product Innovation: Introduce innovative features or products that meet customer needs and differentiate the company from competitors. A compelling product offering can attract new customers and drive growth.

- Customer Acquisition Efficiency: Enhance customer acquisition strategies to acquire new customers cost-effectively. Efficient customer acquisition contributes to increased revenue without a proportional increase in costs.

- Financial Planning: Develop sound financial planning strategies that align with the company’s growth objectives. Ensure that financial decisions support both revenue growth and profitability goals.

For more information on improving Rule of 40, check out these tips from Jeremey Donovon from Insight Partners.

By focusing on these strategies, businesses can work towards improving their Rule of 40, achieving a balanced combination of growth and profitability. Regular monitoring, analysis, and adaptation based on performance data contribute to sustained improvements over time.