The Blind Spot in Portfolio Oversight

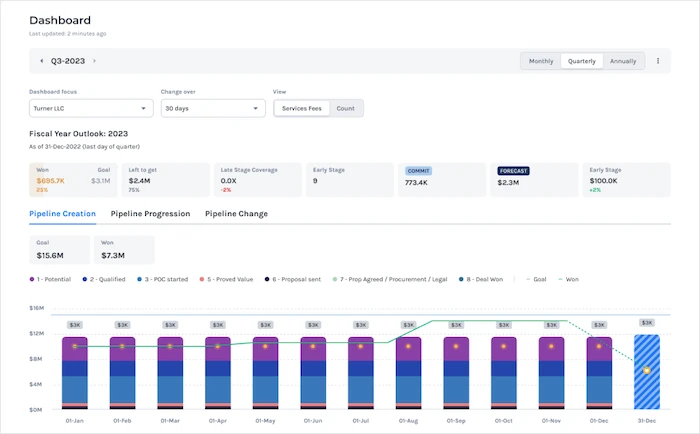

Financial metrics are well managed. Revenue, EBITDA, and cash flow are reported with precision, but they only tell part of the story, and often too late.

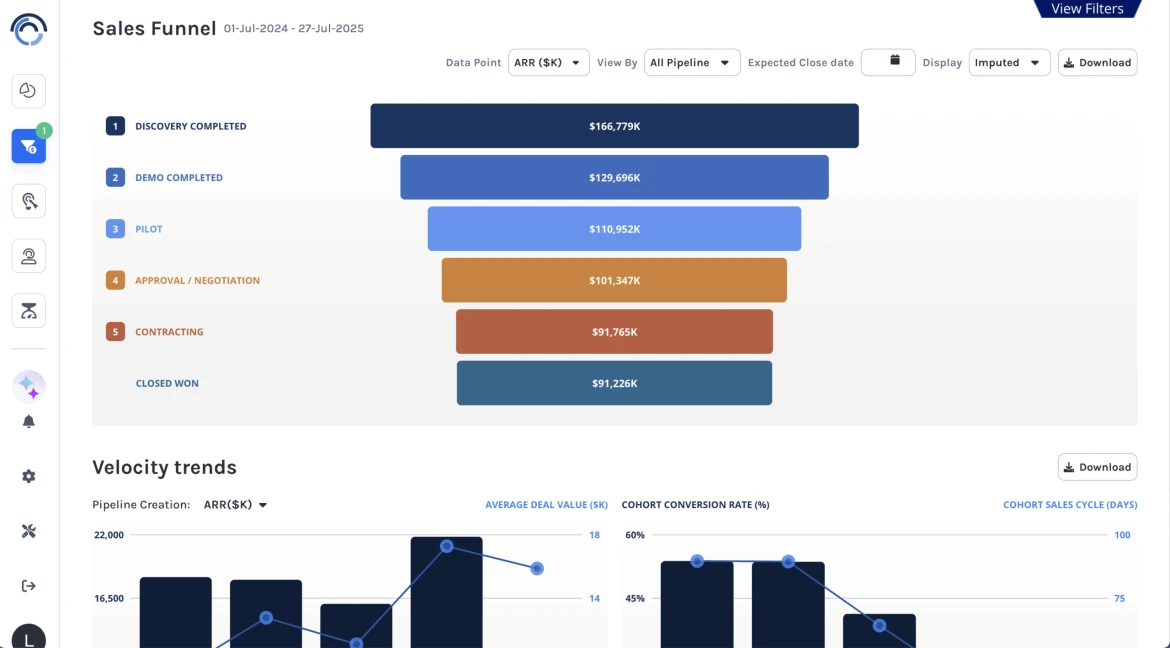

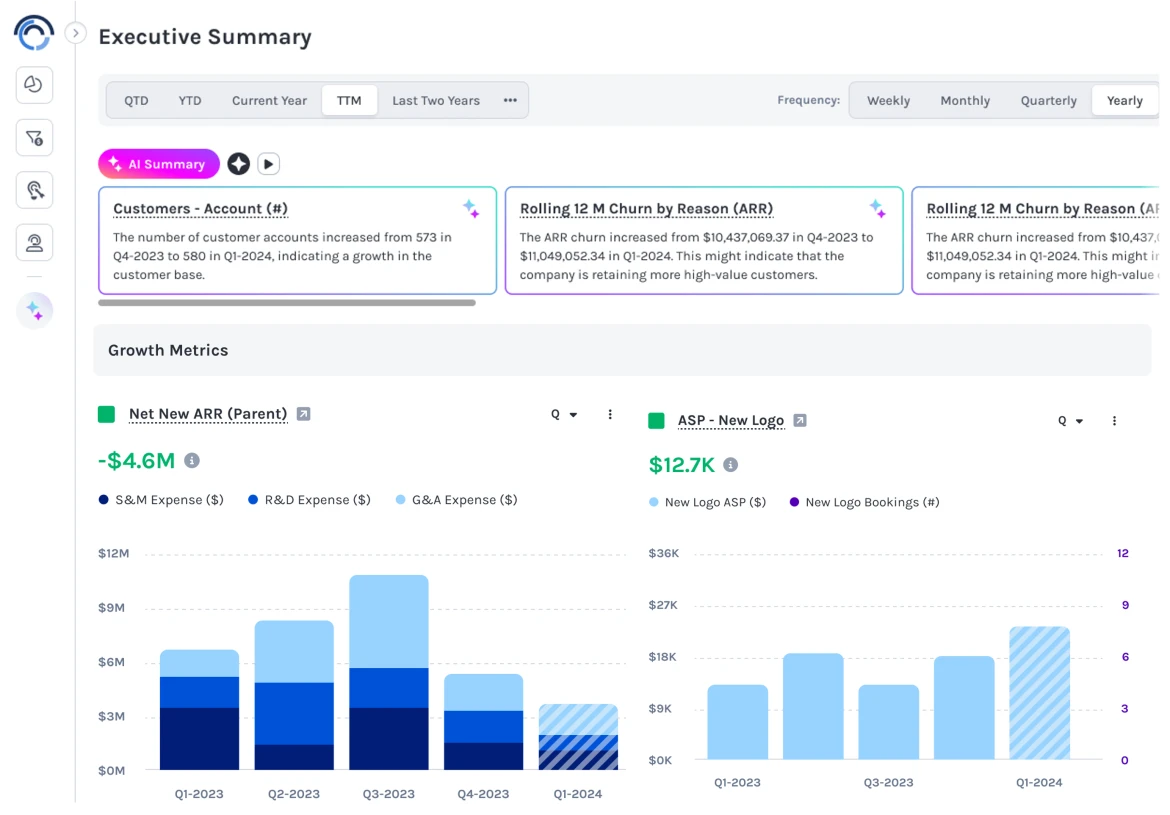

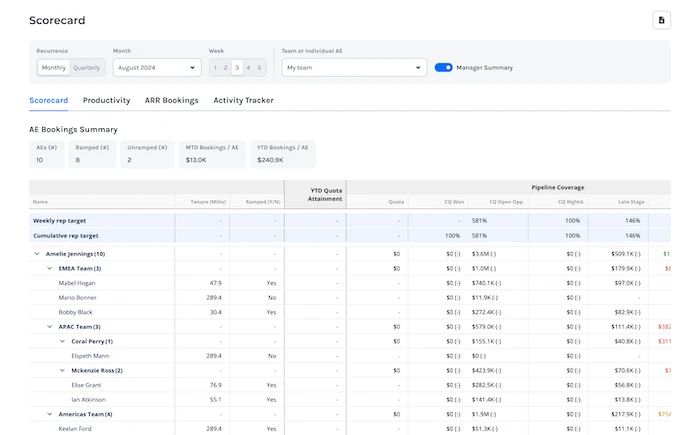

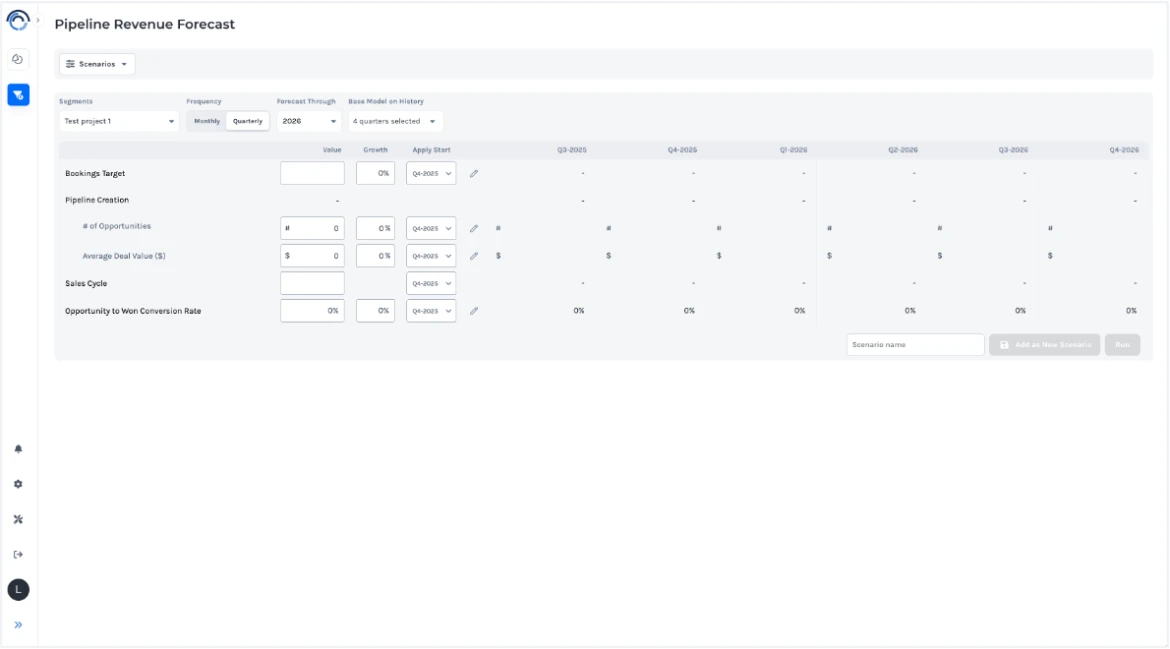

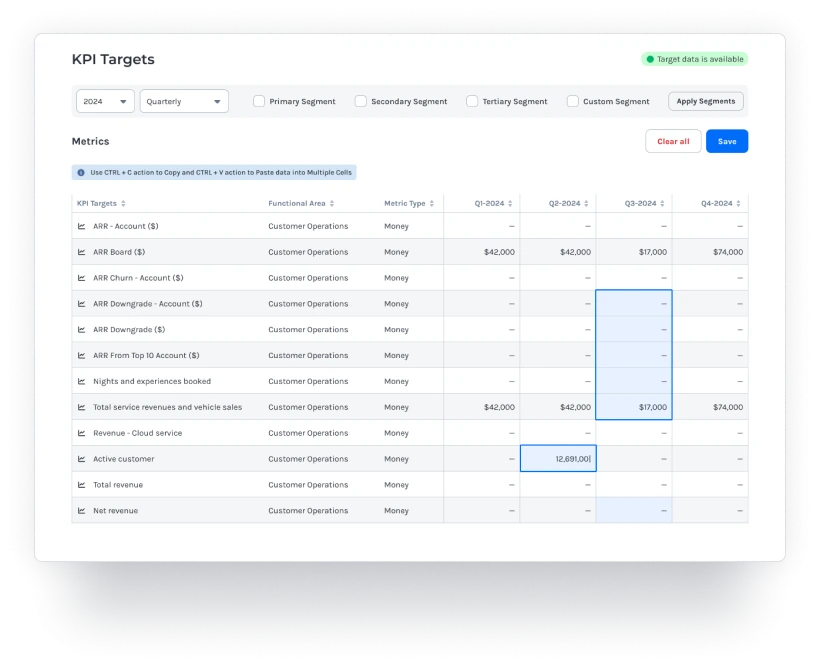

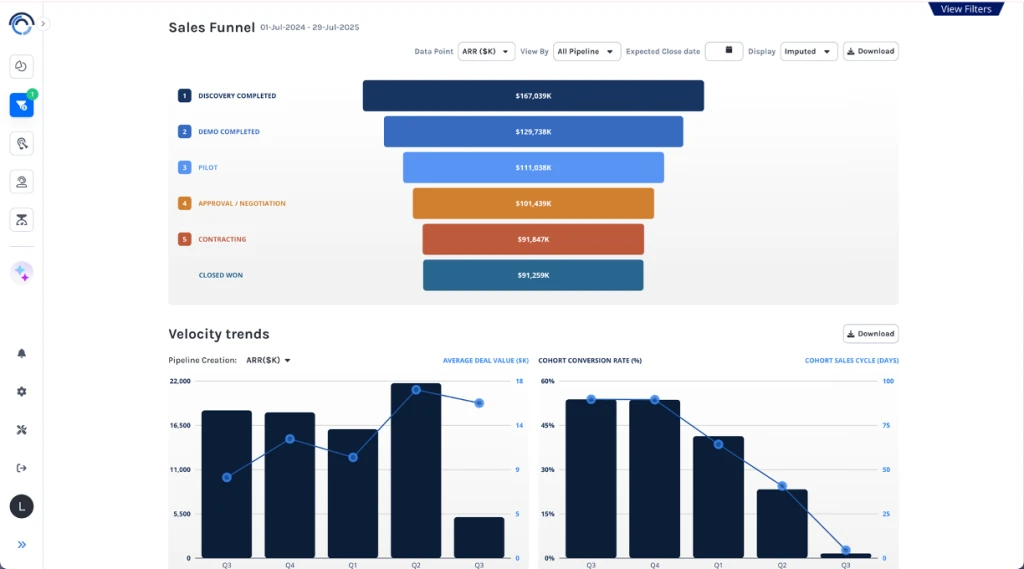

What remains overlooked are the commercial drivers of those numbers: pipeline generation, health, sales velocity, conversion rates, and marketing efficiency. These are the leading indicators that determine whether growth targets will be achieved, yet they are rarely analyzed in a structured, repeatable way at the board level.

CRM data is often messy, full of nuances, and difficult to standardize.

Discern fills this gap with an AI-powered GTM diagnostic solution. Run once or twice a year, Discern equips investment teams and boards with a clear, standardized view of a company’s go-to-market engine- surfacing both opportunities and risks at the company, enabling sharper guidance, earlier interventions, and stronger alignment on strategy.

Why PE and VC Firms Are Choosing Discern for Portfolio Diagnostics

Proactive Performance Management

Identify performance issues weeks or months before they impact financial results, enabling timely interventions and course corrections that protect investment value.

Data-Driven Board Conversations

Transform board discussions from backward-looking financial reviews to forward-looking strategic sessions focused on operational improvements and growth acceleration.

Portfolio-Wide Learning

Identify and replicate best practices across portfolio companies, accelerating value creation through systematic knowledge transfer and operational standardization.

Improved Exit Readiness

Demonstrate operational excellence and predictable growth patterns to potential acquirers with comprehensive data documentation and performance trends.

Operating Partner & Portco Efficiency

Reduce time spent on manual data collection and analysis, allowing operating teams to focus on high-value strategic initiatives and company support.

Discern FAQs

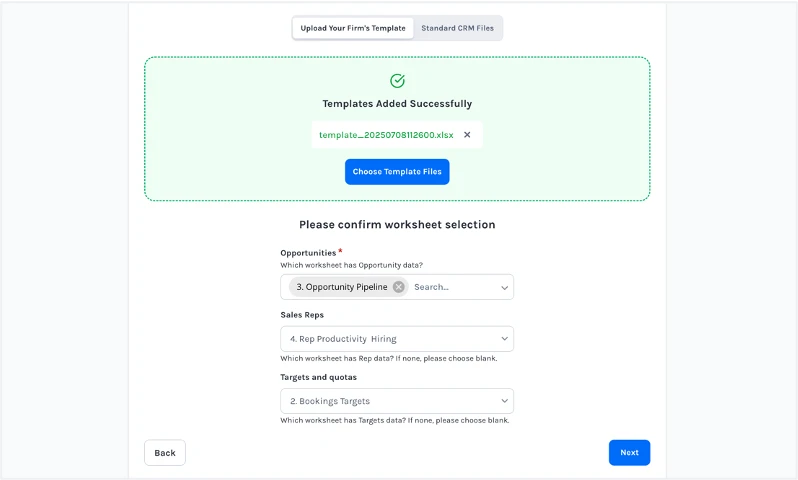

Implementation typically takes 1-2 weeks per portfolio company, depending on data complexity. We start with a pilot company to establish templates and processes, then scale efficiently across your entire portfolio using standardized workflows.

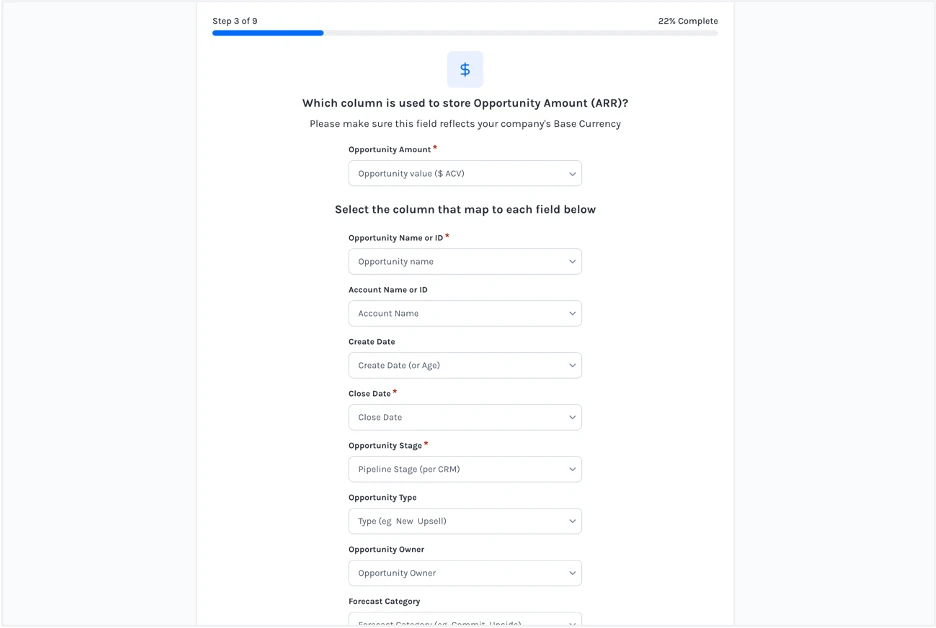

Discern ingests data from spreadsheets or connects directly to Salesforce, HubSpot, Pipedrive, and other major CRM platforms. We also support custom integrations for proprietary systems and can work with existing data warehouses or business intelligence tools.

Absolutely. Our operational KPI module allows complete customization of metrics, calculations, and reporting structures to match your investment thesis and sector-specific requirements while maintaining portfolio-wide comparability.

We offer preferential pricing for private equity and venture capital firms implementing across multiple portfolio companies. Contact us to discuss volume pricing and pilot program options.

There’s minimal disruption to existing workflows. Discern pulls data directly from existing systems, requiring only initial field mapping and configuration. Portfolio companies benefit from enhanced visibility into their own operations.

Give Your Board Members the Full Picture

Get out of Excel. Get into the value behind the data. See how Discern transforms portfolio oversight into a strategic advantage that protects and grows enterprise value.