Trusted by PortCos in Best-in-Class Investment Funds

The SaaS CFO’s Nightmare

Legacy portfolio monitoring tools have turned investor reporting into a headache for SaaS CFOs. These systems require hours of filling out massive spreadsheets just to send data back to a centralize investor platform.

Investors need this information to offer tailored advice, but with the burden on CFOs, information can usually only be gathered quarterly. The outcome? A frustrating process that delivers limited value to CFOs and investors alike.

Discern offers a smarter way forward. By ingesting and analyzing business data directly from the sources, Discern helps each business decide what, when and how to share data —all with minimal effort.

This means CFOs can provide more accurate, timely information, freeing them from the grind of inefficient reporting, while enabling operating partners to actually create value.

Board and Investor Relations Made Easy

Increased Confidence

Most investors and boards have clear expectations when it comes to transparency. Discern’s analytics make it easy to share the information your stakeholders crave, helping increase collaboration and confidence.

Improved Organization

Discern takes the pain out of sharing information with your boards, private equity or venture capital investors on a regular cadence. Discern’s reporting makes it easy to collaborate outside of board meetings.

Clear Alignment

Discern provides the full context both you and your investors need to align on informed, data-driven strategies.

Improved Efficiency

Save dozens of management team hours every month or quarter spent on the Private Equity, Venture Capital and board reporting process. Select the automated reporting option that best aligns to your processes and your investors’ expectations.

Case Study

The Challenge

Prior to Discern, IronEdge found it difficult to access comprehensive and actionable insights from Salesforce. Without centralized, milestoned sales analytics, it was hard to quickly uncover insights behind performance and align with investors on strategic initiatives.

Discern’s Solution

Today, Discern provides IronEdge with a comprehensive suite of configurable sales analytics that enable both IronEdge and their investor, Riverside, to tailor the solution to person specific needs, ensuring seamless integration with existing processes and systems.

Insights Straight from the Source

Discern directly connects to your systems to pull accurate, real-time metrics and KPIs, without the need for manual data management.

Customer Testimonials

Discern FAQs

Yes, Discern Investor Reporting software doubles as board management software. Discern streamlines board management by allowing you to share critical data with board members and automate board reporting.

Discern’s technology integrates seamlessly with your existing platforms pulling in the precise data you need. You start by mapping your data to Discern, ensuring that only the most relevant information is captured.

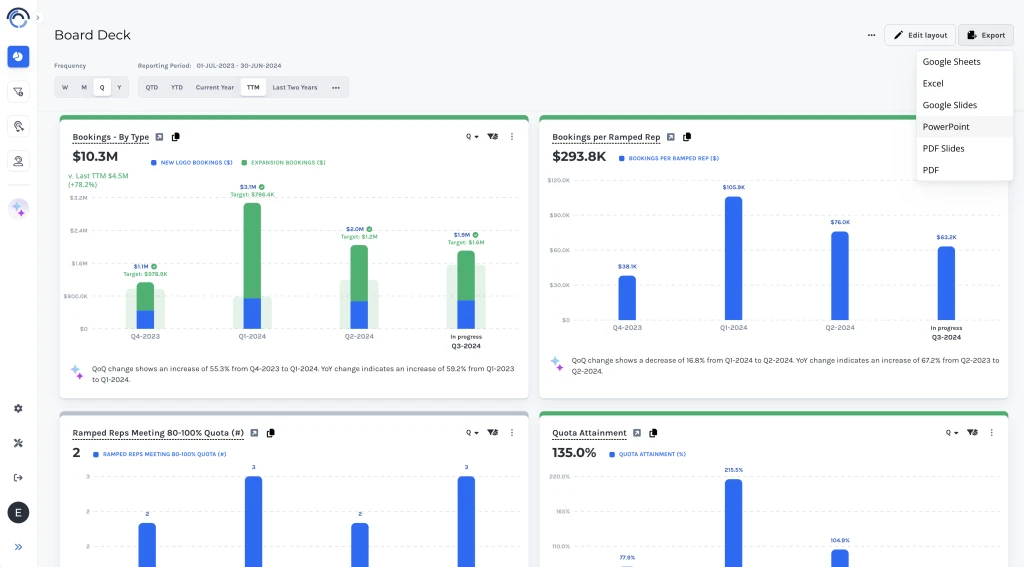

Once the data is integrated, Discern allows you to upload targets and choose when and how to share reports with each investment fund or board member. Options include: automated report distribution, template completion, or push-button board decks creation.

At Discern, we believe in “your data, your decision.” It’s only fair. Just because you track essential metrics in Discern doesn’t mean you have to share everything with each investment fund.

You have full control over what gets shared—whether it’s specific metrics, documents, reports or entire dashboards, striking the right balance of transparency, security and confidentiality.

Additionally, Discern upholds strict data security standards and is SOC 2 Type 2 and SOC 3 compliance.

Discern makes it easy for you to report to prospective investors during due diligence in a capital raise. By centralizing all performance data, Discern makes it easy to share the data each prospective PE fund or Venture Capital fund is requesting.

Want to Wow Your Investors and Board Members?

Book a meeting to learn how Discern can improve investor relations with accurate KPI insights.

Investor Reporting & Board Management FAQs

Investor reporting refers to the regular communication of financial and operational reports from a portfolio company to its investors. This reporting typically includes financial statements, cash position information, performance metrics, and strategic updates. It helps align a business to their investors outside of regular meetings.

Discern simplifies this by offering essential tools that streamline or even fully automate investor reporting, saving management team time and reducing the risk of errors. Investor reporting helps investors and boards focus on where and how to deploy their advice and best practices.

Reporting requirements often differ between a Private Equity (PE) fund and Venture Capital (VC) fund due to the nature and stage of the companies they invest in. Private Equity funds usually make larger investments in later-stage companies and expect more detailed and frequent reporting.

On the other hand, Venture Capital firms make smaller investments in small businesses and earlier-stage companies and might not demand as much detailed information, focusing instead on growth metrics.

The primary purpose of investor reporting is to keep stakeholders (Private Equity fund, Venture Capital firms, board members, etc.) informed about performance and strategic direction.

Managing investor relationships through regular reporting is a best practice. Investment funds use the reported documents to identify trends across their portfolios, manage investments, and better offer advice.

A board deck report is a set of documents prepared for a company’s board of directors to be reviewed during board meetings. It is a critical communication tool that helps guide discussions during the board meeting and facilitate alignment among board members.

Discern automates board deck creation by mapping to your standard board deck format, exporting data as of a specific date.

Creating a board deck starts with understanding the key objectives of the board meeting. Begin by outlining sections like finance performance, operational updates, and strategic initiatives, then gather the necessary data.

Discern can help save time and resources during the board meeting preparation process, allowing you to automate creation and distribution, allowing resources to focus on strategy rather than data analysis.

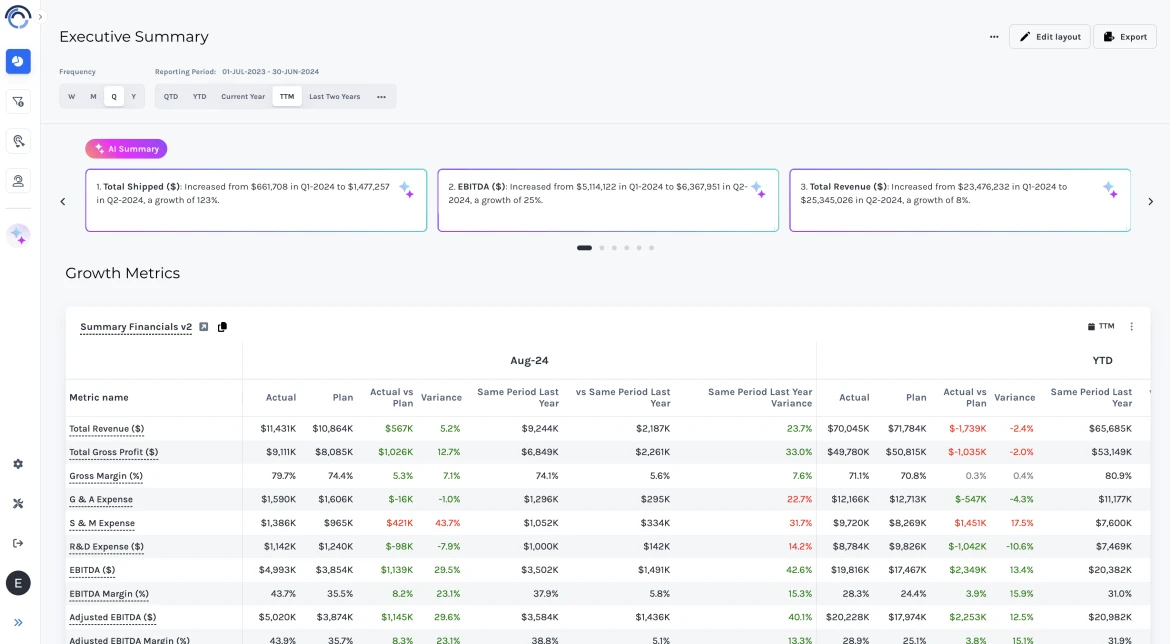

A board presentation should be concise and focused on what matters most to your board. Typical boards want to see:

- Future priorities and top risks

- Executive Summary

- Company performance (financial statements & cash projections and functional KPIs)

- Updates on strategic initiatives, HR, deal activity, and GTM efforts